From Budget Hotels to Bitcoin Billions: The Metaplanet Story

In a surprising twist, a relatively obscure Japanese company has just leapfrogged one of the world’s most famous tech giants—Tesla—in a high-stakes financial game: Bitcoin accumulation.

Meet Metaplanet (Ticker: 3350), a Tokyo-based firm that started as a budget hotel operator, pivoted to software, and has now emerged as a major player in the cryptocurrency market. Its latest move? A $133 million Bitcoin shopping spree, adding 1,234 coins to its already massive stash.

With this purchase, Metaplanet now holds 12,345 BTC, edging out Tesla’s 11,509 BTC and securing its spot as the seventh-largest corporate Bitcoin holder worldwide.

But how did this happen? And what’s next for this ambitious firm?

The Bitcoin Power Rankings: Who Holds the Most?

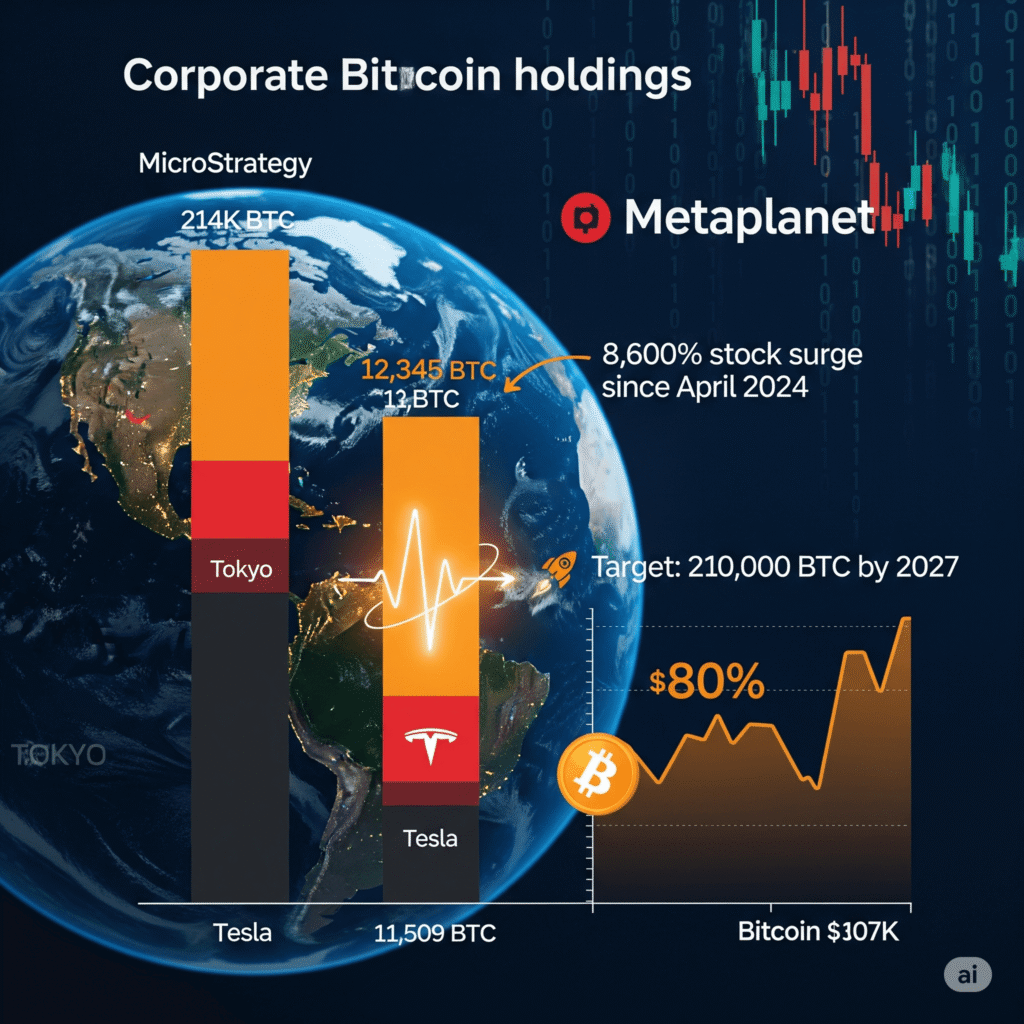

Metaplanet’s latest acquisition puts it ahead of Tesla, but it’s still trailing behind some of Bitcoin’s biggest institutional investors. Here’s how the leaderboard looks today:

- Riot (Mining Company) – 19,255 BTC

- Galaxy Digital (Mike Novogratz’s Fund) – 12,830 BTC

- CleanSpark (Mining Company) – 12,502 BTC

- Metaplanet – 12,345 BTC

- Tesla – 11,509 BTC

The race is heating up—and Metaplanet isn’t slowing down.

A Bold Vision: 100,000 BTC by 2026

Metaplanet isn’t just dabbling in Bitcoin—it’s all in. The company has adopted a strategy similar to MicroStrategy, the enterprise software firm turned Bitcoin behemoth led by Michael Saylor.

In early June, Metaplanet unveiled an audacious plan:

- Purchase 210,000 BTC by 2027

- Amass 100,000 BTC by 2026

- Raise $5.4 billion through stock offerings to fund its Bitcoin acquisitions

So far, they’ve already secured $515 million by issuing new shares, marking just the first phase of their aggressive expansion.

Why Is Metaplanet Betting Big on Bitcoin?

The company’s leadership sees Bitcoin as a long-term store of value, a hedge against economic instability, and a cornerstone of its financial strategy. By mirroring MicroStrategy’s playbook, Metaplanet is positioning itself as a major institutional holder in the crypto space.

And investors are taking notice.

Since announcing its Bitcoin pivot in April 2024, Metaplanet’s stock has skyrocketed by an eye-popping 8,600%, while Bitcoin itself has climbed about 80% to $107,000.

As of June 26, shares of Metaplanet (3350) are trading around 1,510 yen—a staggering rise for a company that once operated budget hotels.

What’s Next? A Potential Challenge to MicroStrategy’s Throne

If Metaplanet stays the course, it could soon become the second-largest corporate Bitcoin holder, trailing only MicroStrategy, which currently holds over 214,000 BTC.

That’s a big “if,” of course. Market conditions, regulatory shifts, and Bitcoin’s notorious volatility could all impact Metaplanet’s trajectory. But one thing is clear:

This isn’t just another corporate crypto experiment—it’s a full-scale financial revolution.

Will Metaplanet’s gamble pay off? Only time will tell. But for now, the company has firmly planted its flag in the Bitcoin landscape—and even Elon Musk’s Tesla is looking up at it.

Final Thought: A New Era of Corporate Bitcoin Adoption?

Metaplanet’s rise signals a growing trend: Companies are no longer just investing in Bitcoin—they’re building entire strategies around it.

Whether this becomes the new norm or a high-risk experiment remains to be seen. But one thing’s certain:

The race for Bitcoin dominance is on—and the underdogs are leading the charge.

What do you think? Will more companies follow Metaplanet’s lead? Let us know your thoughts! 🚀