Wave of crackdown on US exchange regulators hits companies behind decentralized trading platforms

Cryptocurrency exchange dYdX, one of the most popular DeFi trading platforms, is on its way to becoming a fully decentralized project, and the policy of the US authorities plays a role in this. Now it works on a hybrid decentralized model, but in September, the developers plan to launch its new version. This should help to reduce the influence of centralized structures, on which it has so far been forced to rely.

The operation of the exchange depends at least on the dYdX Trading behind it and StarkWare’s solutions for scaling trading opportunities on the Ethereum network. In the new version, dYdX will run on the Cosmos blockchain and use its own protocols to minimize dependence on centralized links, any of which could potentially be pressured by regulators.

The head of the department believes that most cryptocurrencies have the characteristics of securities and are subject to regulation. Experts interviewed by RBC Crypto told what other sanctions market participants should be prepared for

In a recent interview with New York Magazine, Securities and Exchange Commission (SEC) Chairman Gary Gensler shared his thoughts on cryptocurrencies and their potential regulation. The head of the department believes that any crypto assets, in addition to bitcoin, can be classified as securities for a number of reasons and fall under the relevant legislation.

Gensler speaks positively about blockchain technology, noting transparency and resistance to hacker attacks. He says he is “delighted with this technical creation” and sees its potential in certain situations.

Decentralized finance (DeFi) projects are distinguished by the absence of intermediaries in trading or lending operations in crypto assets. The role of an intermediate link is played by an automated protocol – a smart contract. However, as with dYdX, the development of this protocol is the responsibility of a specific company and development team.

Most DeFi projects issue their own tokens that are traded on crypto exchanges. After the head of the US Securities and Exchange Commission (SEC) Gary Gensler stated that almost all existing crypto assets are considered by the agency as securities, any issuer of tokens potentially falls under the supervision of the agency.

“Repression of epic proportions”

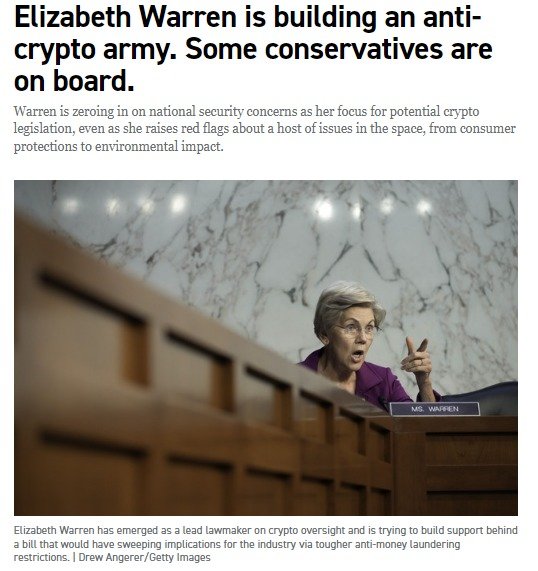

Speaking to community members during a conference call on March 30, the head of another decentralized exchange, SushiSwap, Jared Gray, shared that he “stopped getting inspiration” from work. Gray spoke candidly about his attitude towards American regulators, in particular, mentioning the election program of Senator Elizabeth Warren, part of which is a complete ban on transactions with cryptocurrencies in the United States. Politico published an article about Warren, writing in the headline that she is “raising an army against cryptocurrencies.”

According to remarks he made during the protocol’s ask-me-anything call on Thursday, Sushi Swap Head Chef Jared Grey is no longer feeling “inspired” after a wave of regulatory crackdowns on cryptocurrency exchanges, including the decentralized exchange (DEX) he manages, have put tremendous pressure on the industry.

Before the community slowly trickled into the Discord call, which CoinDesk attended, Grey spoke openly about his emotions toward US authorities and the general health of his industry to three other speakers within the first few minutes of the hour-long public meeting.

“I honestly feel like the majority of that sense [of excitement] from this last cycle is gone now,” Grey remarked. “Have a look at what’s happening on the regulatory front. For example, Senator [Elizabeth] Warren said this morning that she is organizing an anti-crypto army to subdue the internet.”

A week earlier, Gray revealed that he received a subpoena from the SEC in connection with his involvement in SushiSwap. To fund the upcoming litigation, Gray has submitted a proposal to the exchange’s existing decentralized autonomous organization (DAO) to set aside $4 million from the protocol’s treasury to create a “Sushi DAO Legal Defense Fund.”

“This is about an onslaught and repression of epic proportions, and it will only get worse,” warns former SEC official John Reed Stark in a commentary to Bloomberg . Stark has served as the agency’s senior advisor and head of Internet law enforcement. According to his observations, regulators initially did not touch the market leaders, focusing on easily accessible projects. But now they are also targeting the big players.

Earlier this year, the SEC sued the Gemini crypto exchange over its Earn program, which allowed exchange users to earn interest on lending their tokens. The service then fined the Kraken exchange $30 million, equating its staking service with making money on unlisted securities. Later, the agency banned Paxos from issuing the BUSD token, which at that time was considered the official stablecoin of the Binance exchange and was inferior in terms of capitalization only to USDC from Tether and USDC from Circle.

The U.S. Securities and Exchange Commission (SEC) filed a lawsuit in the U.S. District Court for the Southern District of New York against the crypto broker Genesis Global Capital and the Gemini exchange, accusing them of violating the Securities Act. A posting on the regulator’s website states that according to court documents, crypto exchange and crypto lender Genesis offered and sold unregistered securities under the Gemini Earn program.

Investors in this product on the Gemini platform were offered to earn up to 8% per annum. According to the SEC, under the proposed program, investors loaned their crypto assets to Genesis, and Gemini acted as an intermediary and deducted a fee, sometimes as high as 4.29%, from clients’ income.

Binance itself is facing legal action from the Commodity Futures Trading Commission (CFTC). The agency accuses the largest crypto exchange of facilitating illegal activities and trading manipulations.

US exchange regulators are bringing charges against the largest crypto exchange and are trying to disconnect it from the US market. We tell who can take advantage of the situation and what are the risks for Binance and its users

The US Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Binance and its executives. The regulator intends to completely deprive the largest crypto exchange of the American market and accuses it of facilitating illegal activities and trading manipulations.

The text of the accusation took up 74 pages. Referring to quotes from internal chats that the agency was able to gain access to, service representatives accuse the exchange, its head Changpeng Zhao and former compliance director Samuel Lim of knowingly allowing Americans to trade cryptocurrency derivatives without a license, which is a gross violation of US law. . The CFTC also alleges that Binance, bypassing money laundering (AML) and know-your-customer (KYC) laws, deliberately helped large US clients bypass their own compliance procedures.

At the end of March, the SEC accused Justin Sun, founder of the Tron blockchain and co-owner of the Huobi exchange, of artificially inflating trading volumes on the exchange. Literally on the same day, Coinbase received a notice from the SEC threatening to sue a number of tokens and financial products available on the platform.

“Full decentralization”

Decentralized exchanges are already surpassing Coinbase in terms of trading volume. Uniswap reached $71.6 billion in March, according to The Block Research. This is 45% higher than Coinbase ($49.4 billion) in the same month. Among traditional crypto exchanges, Coinbase is second only to Binance in terms of turnover.

Summing up the results of the first quarter of this year, representatives of Coinbase wrote that the trends on the exchange reflect the broader market. The actions of the SEC and the CFTC only highlight the uncertainty around Ethereum and other altcoins, the publication says.

Referring to the situation with Coinbase, in an interview with Bloomberg , the head of dYdX, Antonio Giuliano , says that against the backdrop of what is happening, more and more crypto companies refuse to actively interact with regulators in the United States. After the launch of the new version of the exchange, his company dYdX Trading will continue to work on the protocol. The project employs about 50 people, and they receive a salary from funds received from investors and trading commissions of the exchange.

One of the most popular DeFi trading platforms, the cryptocurrency exchange dYdX, is getting closer to becoming a truly decentralized initiative as international regulators scrutinize the digital asset market more closely.

The exchange is establishing a testing network so that programmers may look for bugs before the official release of the upcoming edition of dYdX, which it claims as operating in a hybrid decentralized architecture. The exchange plans to launch the update in September.

The upgraded network, also known as v4, or version four, aims to do away with the centralized corporations that are currently in charge of running the exchange. The exchange relies on StarkWare, a blockchain technology supplier, to manage some transactions, and dYdX Trading Inc. to monitor and match transactions data on the Ethereum network.

Giuliano said the network that will run the next version of dYdX will work with multiple transaction validators to minimize the risk of being banned or censored by a centralized mechanism. The exchange will technically not have the ability to reject or censor transactions, and the access rights of administrators will be deliberately limited.

“I think that the final form for everything that is in DeFi should be full decentralization,” says Giuliano. “The intermediate link will not exist indefinitely.”