The Bitcoin community is buzzing with anticipation as the clock ticks down to the next halving event, a pivotal moment programmed into Bitcoin’s code that significantly impacts its supply and mining rewards. With just one week remaining, let’s delve into what this halving entails, its potential implications, and what to expect in the coming days.

Bitcoin’s Halving Mechanism: A Built-In Scarcity Driver

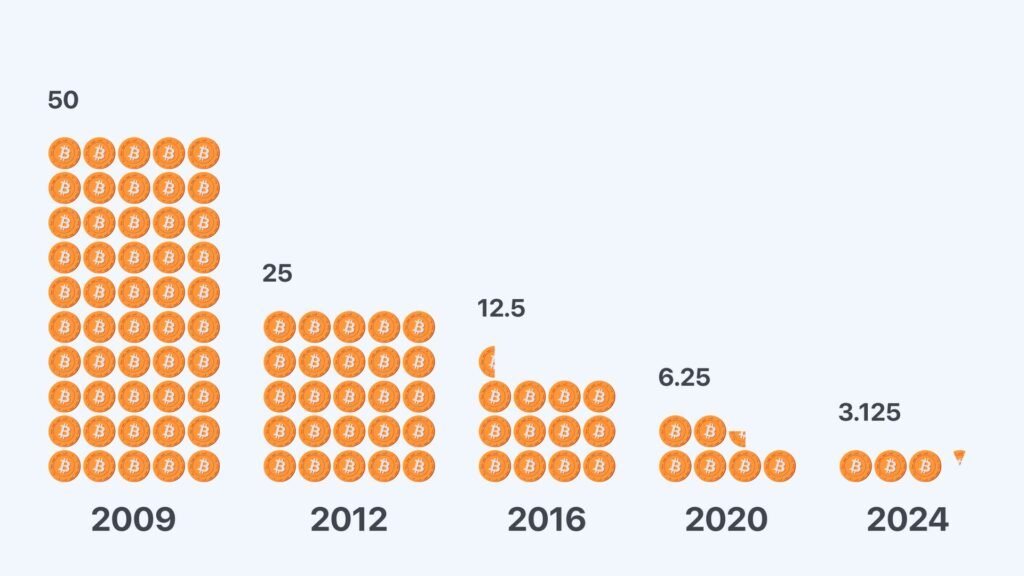

Bitcoin’s supply is capped at 21 million coins. To distribute these coins and incentivize network security, Bitcoin rewards miners with new coins for verifying transactions. This reward is halved roughly every four years, an event known as the halving. This pre-programmed feature ensures a predictable and diminishing supply of new Bitcoins entering circulation.

The upcoming halving will be the fourth of its kind, with the block reward for miners dropping from 6.25 BTC to 3.125 BTC per block mined. This effectively cuts the rate at which new Bitcoins are created in half.

The Countdown and Estimated Timeline

According to The Block’s halving countdown, the estimated date for the next Bitcoin halving is April 20, 2024. This estimation is based on Bitcoin’s average block generation time of 10 minutes. As of today, April 15, 2024, reaching the next halving block height of 840,000 could potentially occur around 9:00 AM UTC (5:00 AM ET). However, it’s important to note that this is an estimate. Bitcoin’s block generation time can fluctuate slightly, so the actual halving date and time could vary.

Bitcoin Halving Timeline

| Event | Estimated Date & Time |

|---|---|

| Next Halving | April 20, 2024 |

| Block Reward Before | 6.25 BTC |

| Block Reward After | 3.125 BTC |

Mining Difficulty Reaches All-Time High: Prepping for the Halving

As the halving approaches, Bitcoin’s mining difficulty has surged to a new all-time high. This signifies increased competition among miners to secure the next block and claim the diminishing block reward. This difficulty adjustment ensures the network maintains its target block generation time of 10 minutes despite the reduced reward.

The “Sell-the-News” Event: Will the Halving Trigger a Price Dip?

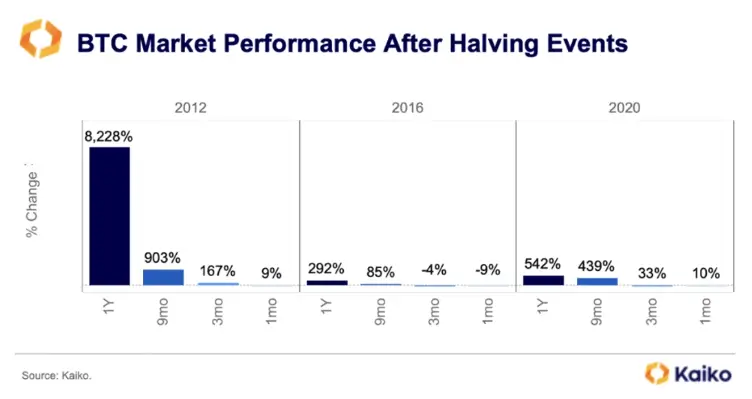

A common question surrounding halving events is whether they trigger a “sell-the-news” event, where investors anticipating a price surge sell their holdings after the news materializes, leading to a temporary price dip. Historically, Bitcoin’s price has experienced significant growth following halving events, although the timeframe for this growth can vary.

I am buying 10 more Bitcoin before April. Why? The “Having.” If you can’t afford a whole Bitcoin you may want to consider buying 1/10 of a coin, via the new ETFs or Satoshi’s.

— Robert Kiyosaki (@theRealKiyosaki) March 25, 2024

If the Bitcoin process works as designed you may own a whole Bitcoin by the end of this year.

I…

Historical Bitcoin Price Performance After Halving Events

| Halving Year | Pre-Halving Price (USD) | Post-Halving Peak Price (USD) | Time to Peak |

|---|---|---|---|

| 2012 | $12.31 | $1,138 (2013) | 1 year |

| 2016 | $434 | $20,089 (2017) | 1 year |

| 2020 | $7,267 | $69,000 (2021) | 1 year |

While past performance is not indicative of future results, these historical trends suggest that the price impact of the halving might not be immediate. Some analysts believe a price surge could occur months after the event, as the long-term effect of reduced supply becomes more evident.

Deep Dive: Exploring the Technical and Economic Implications of the Halving

Beyond the potential price impact, the Bitcoin halving presents intriguing technical and economic considerations. Let’s explore some key aspects:

Technical Considerations

- Mining Difficulty: As mentioned earlier, the mining difficulty is expected to remain high post-halving due to increased competition among miners for the reduced reward. This could incentivize miners to invest in more efficient hardware to maintain profitability.

- Hash Rate: The overall processing power dedicated to securing the Bitcoin network, measured in hashrate, might see some fluctuations initially. However, a long-term trend of increasing hashrate is still anticipated as the value of Bitcoin remains attractive to miners.

- Block Time: With fewer Bitcoins being created per block, the average block time could theoretically increase slightly. However, Bitcoin’s self-adjusting difficulty mechanism should ensure the network maintains its target block time of roughly 10 minutes.

Economic Considerations

- Supply and Demand: The halving undeniably reduces the supply of new Bitcoins entering circulation. This, coupled with potentially increasing demand from institutions and retail investors, could create upward pressure on Bitcoin’s price in the long term.

- Scarcity Premium: The limited and predictable supply of Bitcoin becomes even more pronounced with each halving event. This scarcity could contribute to a “scarcity premium,” where investors value Bitcoin more due to its finite quantity.

- Store of Value: The halving reinforces Bitcoin’s potential as a store of value. Similar to precious metals with a limited supply, Bitcoin’s predictable issuance schedule could make it a more attractive hedge against inflation over time.

A Look Ahead: The Road Beyond the Halving

The Bitcoin halving is a significant milestone, but it’s just one piece of the puzzle. Here are some additional factors to consider when evaluating Bitcoin’s future:

- Regulation: Government regulations surrounding cryptocurrency continue to evolve. Clear and supportive regulatory frameworks could bolster Bitcoin’s adoption and mainstream acceptance.

- Institutional Adoption: Increased institutional investment in Bitcoin can significantly impact its price and overall market perception.

- Technological Advancements: Developments in scalability solutions, such as the Lightning Network, can enhance Bitcoin’s transaction capacity and user experience.

The Bitcoin halving serves as a catalyst for change, reminding us of the core principles behind this revolutionary technology. While the immediate consequences remain to be seen, the halving paves the way for a future where Bitcoin continues to evolve and potentially reshape the global financial landscape.

Frequently Asked Questions (FAQ)

Q: What happens to Bitcoin mining after the halving?

A: Mining will continue, but miners will receive a smaller block reward. This may incentivize miners to become more efficient or potentially lead to consolidation within the mining pool.

Q: How will the halving affect the future of Bitcoin?

A: The long-term impact of the halving is yet to be seen. However, it has the potential to further solidify Bitcoin’s position as a scarce digital asset and potentially drive long-term price appreciation.

Conclusion: The Halving – A Catalyst for Change?

The Bitcoin halving is a significant event with the potential to reshape the cryptocurrency landscape. By reducing the rate of new Bitcoin creation, the halving reinforces Bitcoin’s scarcity and could lead to increased demand and price appreciation in the long run. While the short-term price impact remains uncertain, the halving serves as a crucial reminder of Bitcoin’s core design principles and its commitment to a predictable and finite supply.