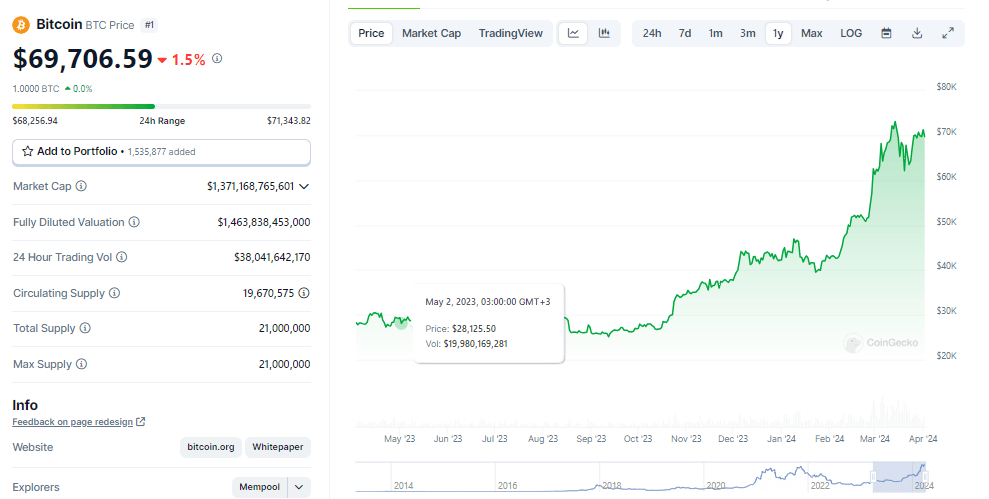

The cryptocurrency market is known for its volatility, with prices fluctuating wildly. Yet, amidst the ups and downs, Bitcoin, the granddaddy of digital currencies, continues to hold a significant position. As we approach the anticipated Bitcoin halving event in April 2024, many industry experts are offering their predictions on the future price of Bitcoin.

This blog post dives into the recent forecast from Mark Yusko, the head of Morgan Creek Capital, a prominent investment management firm. We’ll explore his bullish prediction of Bitcoin reaching $150,000 by the end of 2024, delve into the historical impact of halving events on Bitcoin’s price, and address some frequently asked questions surrounding Bitcoin’s future.

Can Bitcoin Really Reach $150,000 by 2024?

Mark Yusko, a leading figure in the investment world, recently made a bold claim on CNBC. He believes that Bitcoin is poised for significant growth after the upcoming halving event, potentially reaching a price of $150,000 by the end of 2024. Yusko, known for his optimistic outlook on cryptocurrencies, refers to Bitcoin as “the king of cryptocurrencies” and anticipates a surge in demand following the halving.

The Morgan Creek Capital fund, which Yusko heads, boasts a long and successful track record with over $1.5 billion in assets under management.

Understanding the Impact of Bitcoin Halving

Bitcoin halving is a pre-programmed event written into Bitcoin’s code that occurs roughly every four years. It effectively cuts the reward for mining new Bitcoins in half, which can significantly impact supply and demand dynamics.

Historically, halving events have been followed by bullish periods for Bitcoin’s price. Here’s a closer look:

- 2012 Halving: Following the 2012 halving, Bitcoin witnessed a staggering price increase of approximately 8,000% within the subsequent year.

- 2016 Halving: The 2016 halving was followed by a nearly 1,000% price surge in the year that followed.

- 2020 Halving: The most recent halving in May 2020 ushered in a bull market that culminated in Bitcoin reaching an all-time high of nearly $69,000 in November 2021.

Historical Impact of Bitcoin Halving Events on Price

| Year of Halving | Price Change After 1 Year |

|---|---|

| 2012 | +8,000% |

| 2016 | +1,000% |

| 2020 | New All-Time High Reached in Following Year |

While past performance isn’t always indicative of future results, these historical trends suggest that halving events can trigger significant price increases for Bitcoin.

Factors Influencing Bitcoin Price Prediction

It’s important to acknowledge that Yusko’s prediction, and any other price forecast for Bitcoin, isn’t guaranteed. Several factors can impact Bitcoin’s price, including:

- Market Sentiment: Overall investor confidence in the cryptocurrency market can significantly influence Bitcoin’s price. Positive sentiment can lead to buying sprees, driving the price up, while negative sentiment can trigger sell-offs, causing the price to drop.

- Regulations: Government regulations surrounding cryptocurrencies can create uncertainty and impact adoption, potentially affecting Bitcoin’s price.

- Institutional Investment: The influx of institutional investment into the crypto space can provide a significant boost to Bitcoin’s price and overall market legitimacy.

- Competition: The emergence of new and innovative cryptocurrencies could potentially steal market share from Bitcoin and impact its price.

Frequently Asked Questions (FAQ)

Q: Is it safe to invest in Bitcoin?

A: Bitcoin, like all investments, carries inherent risks. Its price can be highly volatile, and the market is still relatively young. It’s crucial to conduct thorough research and understand your risk tolerance before investing in Bitcoin.

Q: When is the next Bitcoin halving?

A: The next Bitcoin halving is expected to occur in April 2024.

Q: Will Bitcoin always be valuable?

A: The future of Bitcoin and all cryptocurrencies remains uncertain. While some experts believe Bitcoin has the potential to become a mainstream form of payment, others remain skeptical.

Conclusion

Mark Yusko’s prediction of Bitcoin reaching $150,000 by the end of 2024 is certainly an optimistic one. While the upcoming halving event has historically been followed by price increases, it’s not a guaranteed outcome. The cryptocurrency market remains complex and influenced by various factors.

So, will Bitcoin hit $150,000 by the end of 2024?

Only time will tell. However, by understanding the potential catalysts and remaining informed about market developments, you can make more informed decisions about your cryptocurrency investments.

Disclaimer: This blog post is for informational purposes only and should not be considered investment advice. It’s crucial to conduct your own research and due diligence before making any investment decisions.