Experts talked about how the profitability of mining altcoins will change in the near future, and what the transition of Ethereum miners to other networks will lead to

The Ethereum 2.0 update, scheduled for mid-September, will mark the end of the mining era for the second largest cryptocurrency by capitalization. The transition of the blockchain to the Proof-of-Stake protocol forces miners to switch to mining other cryptocurrencies operating on the Proof-of-Work (PoW) protocol.

On the one hand, this will increase the security of the blockchains of such coins as Ethereum Classic (ETC) and Ravencoin (RVN). But along with this, the difficulty of mining these cryptocurrencies will increase. This is an indicator that affects the efficiency of the equipment involved and, accordingly, the profit of the miner.

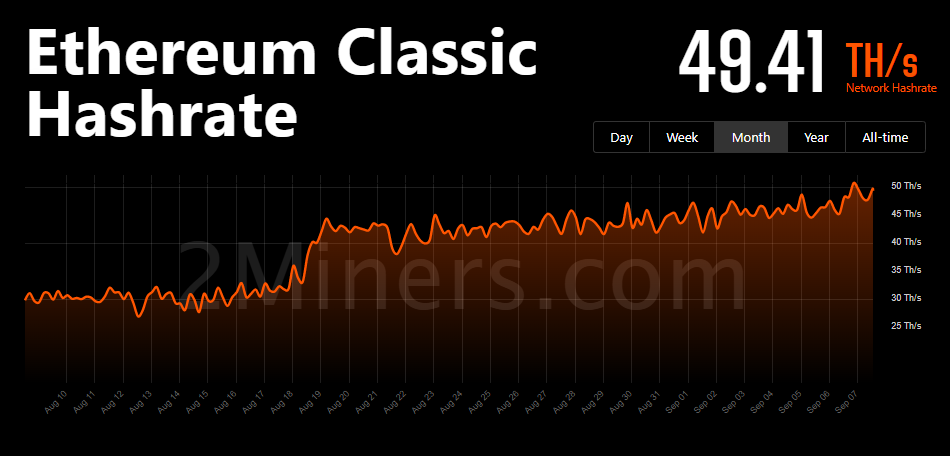

So, in connection with the already begun transition to the Ethereum Classic network of miners, completing the mining of the second largest cryptocurrency by capitalization, on Monday, September 5, the hash rate of the Ethereum Classic network reached the highest level in the entire history of observations.

Experts told about how the Ethereum update will affect the profitability of mining and what are the prospects for the altcoin mining industry.

Big blackout

After switching computing power from Ethereum to other PoW coins, the complexity of their mining will increase tenfold, said Sergey , co-founder of BitCluster. According to him, in order for the yield to remain the same, the rate of these coins must rise accordingly, which is almost unrealistic.

If the increase in the rate turns out to be less than the increase in complexity, then it will become simply unprofitable to mine such cryptocurrencies as ETC, Beam, RVN, the expert believes. He noted that as a result of this, most mining farms on video cards will turn off, and the complexity of blockchains will begin to fall until it finds a happy medium.

The specialist admitted that only farms with the lowest cost of electricity will remain in mining on such coins, 90% of devices will have to be turned off. Of course, the “Merger” (updating the blockchain) can bring surprises that we don’t know about yet, for example, a new fork of Ethereum, which will be supported by the majority of market participants, and this coin will remain working on PoW, but the likelihood of this is small, Arestov believes.

Sale started

Some miners are already selling equipment at a loss, said Ivan , director of the online store for mining equipment and computer components Hardvar. According to him, the demand is low now, the choice of equipment is large, and the prices are low.

Those miners who used credit funds and counted on monthly income may start selling equipment, the specialist believes. As for the rest, everything will depend on the size of the income of the miners after they are reoriented to the production of other cryptocurrencies.

Doubtful prospect

The complication of mining and regulatory measures introduced around the world will somehow affect the profitability of mining various coins, says Artem , head of the analytical department at AMarkets.

He noted that this is an inevitable process – the period when digital financial assets mined by miners is ending, brought increased profits. Previously, this was possible due to the growing popularity of digital assets, the relative availability of equipment, the simplicity of the mining process, the relatively small number of miners in the world, and low electricity tariffs.

Now the factors that will hit mining altcoins in general are becoming more noticeable: the increase in the cost of equipment, the growth of tariffs, the complication of the mining altcoins process and the increase in the number of miners, the analyst believes. He added that the tightening of regulation of mining by states in the US, Europe and Russia, as well as the ban on mining in China, further aggravate the situation.

“Therefore, we can say that now the profitability of cryptocurrency mining is still attractive. But the prospect for the near future already inspires doubts – mining will become less profitable for all assets, ”.