Data from the analytical company indicates that the last wave of withdrawal of the first cryptocurrency from trading platforms began in mid-July and continues to this day.

In mid-October, the outflow of bitcoin from cryptocurrency exchanges slowed down. This is indicated by data from the analytical company Glassnode.

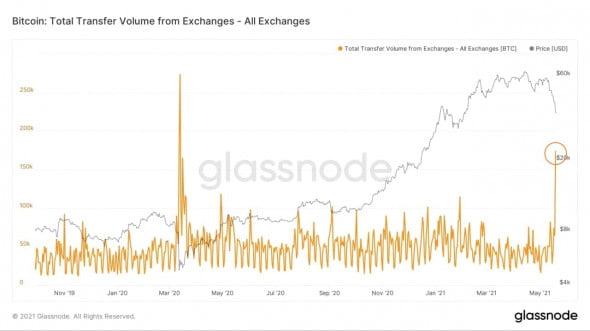

According to Glassnode, the last wave of the outflow of the first cryptocurrency began in mid-July. Prior to that, from May to July, there was a period of bitcoin inflow to trading platforms.

We can see this in the Exchange net position change metric which has been in a net outflow regime since March 2020.

May-July was the primary period of net inflows, however this has been fully reversed.

Exchanges are currently seeing modest outflows of around 20k $BTC per month. pic.twitter.com/lfMfU4334Y

— glassnode (@glassnode) October 14, 2021

Often, the outflow of funds from crypto exchanges is associated with active purchases. For example, on the evening of May 19, after the bitcoin rate fell by a third per day, to $ 30 thousand, the largest withdrawal of digital coins was recorded in a year.

Users withdrew to cold wallets about 175 thousand BTC for $ 7 billion at the exchange rate at that time.

At the end of July, the number of bitcoin on crypto exchanges dropped to a minimum since 2018, when the value of the main cryptocurrency dropped to $ 30 thousand.

Looks like exchange balances just dropped to the lowest they've been since late 2018. Two massive outflows today: one worth 23,530 BTC this morning and another batch worth 40,181 BTC about a half-hour ago.

Would be wild if true. Can we get confirmation? @glassnode @n3ocortex pic.twitter.com/6ihVap6rEd

— Will Clemente (@WClementeIII) July 29, 2021

Then more than 50 operations were recorded to withdraw digital assets from exchanges, the total amount of which is $ 18.5 billion (taking into account the exchange rate at the time of withdrawal).