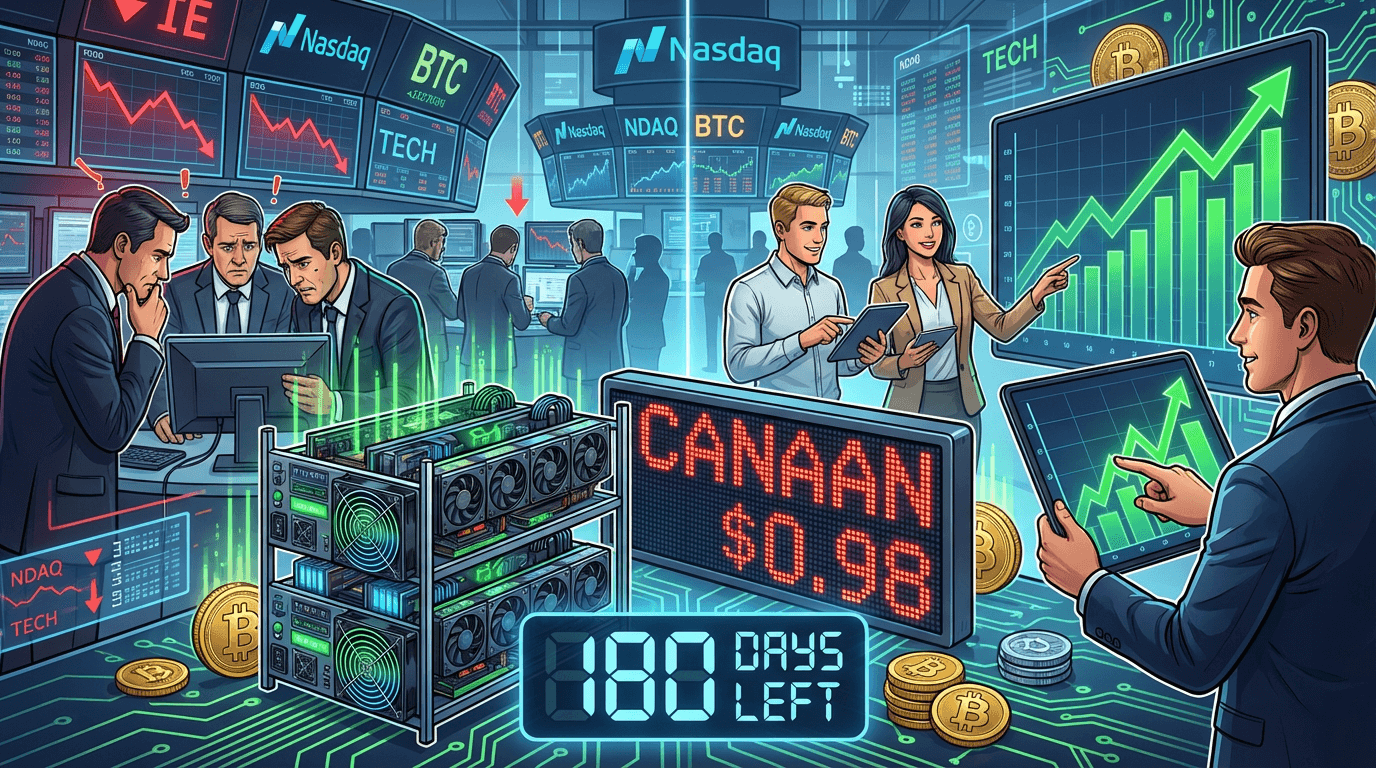

Bitcoin Miner Canaan Has 180 Days to Escape Nasdaq Delisting — Will It Survive?

🔑Key Takeaways

- Canaan, a prominent Bitcoin mining firm, faces a 180-day period to comply with Nasdaq’s minimum bid price requirement of $1.00 per share or risk delisting.

- Maintaining a Nasdaq listing is crucial for Canaan’s access to capital, liquidity, and global market credibility, with delisting potentially leading to a less transparent OTC market.

- Bitcoin mining economics are highly susceptible to Bitcoin price volatility, energy costs, mining difficulty, hardware efficiency, and halving events, creating intense pressure on profitability.

- Canaan’s path to compliance may involve a sustained stock price recovery or a reverse stock split, but long-term survival hinges on operational optimization, hardware innovation, and strategic diversification.

- This case highlights the challenges of integrating volatile crypto businesses into traditional financial frameworks and emphasizes the critical need for business efficiency and resilience in the digital asset sector.

📑Table of Contents

-

- Understanding Nasdaq’s Bid-Price Deficiency Notice

- The Intricacies of Bitcoin Mining Economics

- Canaan’s Journey and the Path to Compliance

- Broader Industry Implications: Connecting Crypto to Business Efficiency and Financial Innovation

- The Road Ahead for Canaan

- FAQ (Frequently Asked Questions)

- Conclusion

◻The dynamic world of digital assets constantly presents a fascinating interplay of technological innovation, market volatility, and corporate resilience. In this landscape, the health and stability of infrastructure providers, such as Bitcoin miners, are crucial indicators of the industry’s maturity and its path forward. A recent development that has captured the attention of investors, industry analysts, and business professionals alike is the formal bid-price deficiency notice issued by Nasdaq to the prominent Bitcoin mining firm, Canaan. This notice marks the beginning of a critical 180-day compliance period, a countdown that will ultimately determine Canaan’s future on the public market and potentially serve as a significant case study for other digital asset enterprises navigating traditional financial frameworks.

◻For companies operating at the cutting edge of Web3 and blockchain technology, maintaining a public listing on a major exchange like Nasdaq is more than just a badge of honor; it’s a fundamental pillar for capital access, liquidity, and global market credibility. Canaan’s predicament, therefore, is not merely an isolated corporate challenge but a reflection of the inherent pressures and evolving demands placed upon businesses deeply embedded in the cryptocurrency ecosystem. Understanding the implications of this warning requires a deeper dive into Nasdaq’s listing requirements, the unique economics of Bitcoin mining, and the broader trajectory of digital transformation in finance and business.

✅Understanding Nasdaq’s Bid-Price Deficiency Notice

💡Nasdaq, renowned for listing innovative and high-growth companies, maintains rigorous standards to ensure the integrity and quality of its marketplace. One such standard is the minimum bid price requirement, which mandates that a company’s stock must maintain a closing bid price of at least $1.00 per share. When a company’s stock trades below this threshold for an extended period, typically 30 consecutive business days, Nasdaq issues a formal notification, as it has done with Canaan.

💡This bid-price deficiency notice is not an immediate delisting order but rather a formal warning and a grace period. Canaan now has 180 calendar days to rectify the situation. The primary way to achieve compliance is for its stock to trade at $1.00 or more for at least 10 consecutive business days within this period. Failure to do so could lead to a delisting from Nasdaq, a scenario with profound consequences for any publicly traded entity.

➖Expert Takes:

“Nasdaq listing standards are designed to protect investors and maintain market quality. For a crypto firm, falling below the minimum bid price often signals deeper operational or market perception challenges that need urgent address, especially in a volatile sector.”

— Financial Market Analyst specializing in Public Companies

💡For a company like Canaan, which manufactures Bitcoin mining equipment and operates its own mining farms, a Nasdaq listing offers unparalleled access to institutional capital, enables greater liquidity for its shares, and enhances its brand reputation on a global scale. Delisting would likely result in its stock moving to an over-the-counter (OTC) market, which is characterized by lower trading volumes, reduced transparency, and significantly less institutional investor interest. This could severely impact Canaan’s ability to raise future capital, fund expansion, and compete effectively in a highly capital-intensive industry.

✅The Intricacies of Bitcoin Mining Economics

To fully grasp Canaan’s challenge, it’s essential to understand the complex economic landscape of Bitcoin mining. Bitcoin mining is a highly specialized and capital-intensive industry, critical for the security and decentralization of the world’s leading cryptocurrency. Miners use powerful, energy-hungry specialized computers (ASICs) to solve complex cryptographic puzzles, thereby validating transactions and adding new blocks to the Bitcoin blockchain. In return, they receive newly minted Bitcoins (block rewards) and transaction fees.

Several factors dictate the profitability and operational sustainability of a Bitcoin mining firm:

-

Bitcoin Price Volatility:

The most significant external factor is the price of Bitcoin itself. Miners’ revenue is directly tied to the value of the Bitcoin they earn. Sustained periods of low Bitcoin prices can push miners into unprofitability, especially those with higher operational costs.

-

Energy Costs:

Electricity is the largest operational expense for miners. Access to cheap, sustainable, and reliable energy sources is a critical competitive advantage. Fluctuations in energy prices, regulatory changes concerning energy consumption, and geopolitical events can dramatically impact a miner’s bottom line.

-

Mining Difficulty:

As more miners join the network, the difficulty of solving the cryptographic puzzles increases. This means individual miners need more computational power (hash rate) to find a block, making it harder to earn Bitcoin.

-

Hardware Efficiency and Obsolescence:

The mining industry is characterized by rapid technological advancement. Newer, more efficient ASICs consume less power per terahash, providing a significant competitive edge. Older, less efficient machines quickly become obsolete, requiring substantial capital expenditure for upgrades.

-

Bitcoin Halving Events:

Approximately every four years, the reward for mining a new block is cut in half. While often priced into the market, halvings significantly reduce miners’ revenue streams overnight, forcing them to become hyper-efficient or exit the market. The most recent halving has intensified this pressure across the industry.

Canaan, as both a manufacturer of ASICs and an operator of mining farms, faces a dual challenge. On the one hand, demand for its mining hardware fluctuates with Bitcoin price cycles and competitive pressures. On the other, its own mining operations are subject to all the aforementioned economic variables, demanding constant optimization and strategic foresight.

✅Canaan’s Journey and the Path to Compliance

🔹Canaan has historically been a significant player in the Bitcoin mining industry, pioneering some of the earliest ASIC development. Its journey to a Nasdaq listing represented a milestone for the digital asset industry, showcasing the potential for crypto-native businesses to integrate into mainstream financial markets. However, the company has faced its share of headwinds, including intense competition in ASIC manufacturing, fluctuating Bitcoin prices, and the cyclical nature of the crypto market.

🔹The 180-day compliance period offers several potential avenues for Canaan to regain its standing. The most straightforward, though often challenging, is a sustained recovery in its stock price driven by positive market sentiment, improved financial performance, or a strategic business announcement.

🔹Another common tactic for companies facing a bid-price deficiency is a reverse stock split. This corporate action reduces the number of outstanding shares and proportionally increases the share price, effectively lifting the stock above the $1.00 threshold. While it doesn’t change the company’s overall market capitalization, it can provide immediate compliance and avoid delisting. However, reverse stock splits can sometimes be viewed negatively by the market, as they might signal underlying challenges or dilute investor confidence.

➡Expert Takes:

“A reverse stock split is a common and often necessary tool for companies facing delisting. While it provides a temporary solution for compliance, true long-term success hinges on demonstrating improved financials, a clear growth strategy, and regaining investor trust.”

— Equity Strategist focused on small-cap tech

Beyond these immediate financial maneuvers, Canaan’s long-term survival and prosperity will depend on fundamental improvements in its business operations and strategic positioning. This includes:

-

Operational Optimization:

Enhancing the efficiency of its mining operations, securing lower energy costs, and optimizing its fleet of mining hardware.

-

Innovation in Hardware:

Continuing to develop competitive, next-generation ASICs that offer superior performance and energy efficiency.

-

Strategic Diversification:

Exploring new revenue streams or optimizing existing ones beyond traditional Bitcoin mining, perhaps leveraging its blockchain expertise in other areas.

-

Capital Management:

Effectively managing its balance sheet, reducing debt, and ensuring sufficient working capital to navigate market downturns and invest in growth.

✅Broader Industry Implications: Connecting Crypto to Business Efficiency and Financial Innovation

Canaan’s situation is not an isolated incident; it resonates deeply within the broader digital asset industry, especially for publicly traded crypto firms and those aspiring to go public. It highlights several critical connections to business efficiency, digital transformation, financial innovation, and operational optimization.

➖Financial Innovation and Market Access

The very existence of publicly traded Bitcoin mining companies like Canaan, Marathon Digital Holdings, Riot Platforms, and others represents a significant step in financial innovation. These companies allow traditional investors to gain exposure to the Bitcoin ecosystem without directly holding cryptocurrency. Their listings on major exchanges democratize access to the underlying infrastructure of Web3. However, events like Canaan’s delisting warning underscore the ongoing challenges in integrating highly volatile, technologically driven crypto businesses into the more conservative frameworks of traditional finance. Maintaining investor confidence and demonstrating consistent financial health is paramount for fostering this crucial bridge.

➖Digital Transformation and Blockchain Infrastructure

Bitcoin mining, at its core, is the engine that drives the Bitcoin blockchain – a foundational technology for digital transformation. The integrity and security of the Bitcoin network rely heavily on a robust and decentralized mining infrastructure. While Canaan’s struggles are specific to its corporate performance, the health of mining companies collectively impacts the perceived stability of the entire network. For businesses exploring blockchain solutions for supply chain management, data integrity, or secure transactions, the underlying infrastructure must be reliable. The operational stability of key players like Canaan indirectly contributes to the confidence in adopting such digital transformation initiatives.

➖Operational Optimization in a Volatile Sector

The Bitcoin mining industry exemplifies the extreme need for operational optimization. Miners operate on razor-thin margins, constantly battling rising difficulty, fluctuating energy prices, and fierce hardware competition. Companies that thrive are those that can secure the cheapest power, deploy the most efficient machines, and adapt quickly to market changes. Canaan’s challenge serves as a stark reminder that even pioneers in the space must continuously innovate and optimize their operations to survive. This relentless pursuit of efficiency—from energy sourcing to hardware deployment and facility management—is a blueprint for any business striving for operational excellence in a rapidly evolving digital economy.

➡Expert Takes:

“The constant pressure on Bitcoin miners to optimize energy consumption and hardware efficiency mirrors the digital transformation imperative across all industries. Businesses that can adapt faster and leverage technology for leaner operations will ultimately succeed.”

— Tech Entrepreneur and Blockchain Consultant

➖Business Efficiency and Resilience

Ultimately, Canaan’s struggle is a testament to the need for unparalleled business efficiency and resilience in the crypto sector. Companies in this space are exposed to unique risks: regulatory uncertainty, extreme market volatility, rapid technological obsolescence, and intense global competition. Those that build strong financial foundations, diversified revenue streams, and adaptable operational models are better positioned to weather downturns and capitalize on growth opportunities. The 180-day countdown is not just about a stock price; it’s about Canaan’s ability to demonstrate its fundamental business viability and its capacity to execute a credible turnaround strategy.

✅The Road Ahead for Canaan

✔The next few months will be pivotal for Canaan. The company will likely explore all available options to regain Nasdaq compliance, potentially including a reverse stock split, if a natural upward movement in its stock price doesn’t materialize. Beyond immediate compliance, Canaan’s management team will need to articulate a clear strategy for long-term growth and profitability, address market concerns, and restore investor confidence.

✔The outcome for Canaan will be closely watched by the entire digital asset industry. Its ability to navigate this challenge successfully could provide valuable lessons for other crypto-native companies aiming for, or currently holding, public listings. It will reinforce the notion that even in the innovative and fast-paced world of Web3, fundamental business principles of sound financial management, operational excellence, and strategic adaptability remain paramount.

📑FAQ (Frequently Asked Questions)

What is a Nasdaq bid-price deficiency notice?

A Nasdaq bid-price deficiency notice is a formal warning issued when a company’s stock trades below $1.00 per share for 30 consecutive business days. It grants the company a grace period, typically 180 days, to regain compliance before facing potential delisting.

How can Canaan regain Nasdaq compliance?

Canaan can regain compliance if its stock trades at $1.00 or more for at least 10 consecutive business days within the 180-day period. This can happen through natural market recovery, improved financial performance, strategic announcements, or corporate actions like a reverse stock split.

Why is a Nasdaq listing important for a Bitcoin miner like Canaan?

A Nasdaq listing provides crucial access to institutional capital, enhances liquidity for its shares, and boosts global brand reputation. Delisting would limit these benefits, likely moving its stock to a less transparent over-the-counter (OTC) market with reduced investor interest.

What factors affect Bitcoin mining profitability?

Key factors include Bitcoin price volatility, energy costs, mining difficulty, hardware efficiency and obsolescence (ASICs), and Bitcoin halving events, all of which directly impact a miner’s revenue and operational expenses.

Conclusion | Canaan’s bid-price deficiency notice from Nasdaq serves as a compelling reminder of the inherent complexities and pressures facing companies at the forefront of the digital asset revolution. While the crypto industry promises groundbreaking financial innovation and drives digital transformation, it also demands rigorous adherence to traditional financial market standards and relentless operational optimization. The next 180 days will not only determine the future of a prominent Bitcoin miner but will also offer valuable insights into the ongoing journey of the digital asset industry as it strives for mainstream integration and sustained growth. For business professionals, entrepreneurs, and crypto enthusiasts, Canaan’s fight for its Nasdaq listing is a real-time case study in resilience, adaptation, and the enduring challenge of bridging the gap between cutting-edge technology and established financial markets.