A Record-Breaking Half-Year for Crypto Crime

The first six months of 2025 have rewritten the history books—but not in a way the crypto industry wanted. A staggering $2.1 billion vanished from digital wallets and exchanges, siphoned away in at least 75 high-profile hacks—a 10% increase over the previous record set in 2022.

To put that into perspective, cybercriminals stole nearly as much in six months as they did in the entirety of 2024. According to TRM Labs, a leading blockchain intelligence firm, this surge isn’t just about bigger payouts—it’s about a fundamental shift in who’s behind the attacks and why.

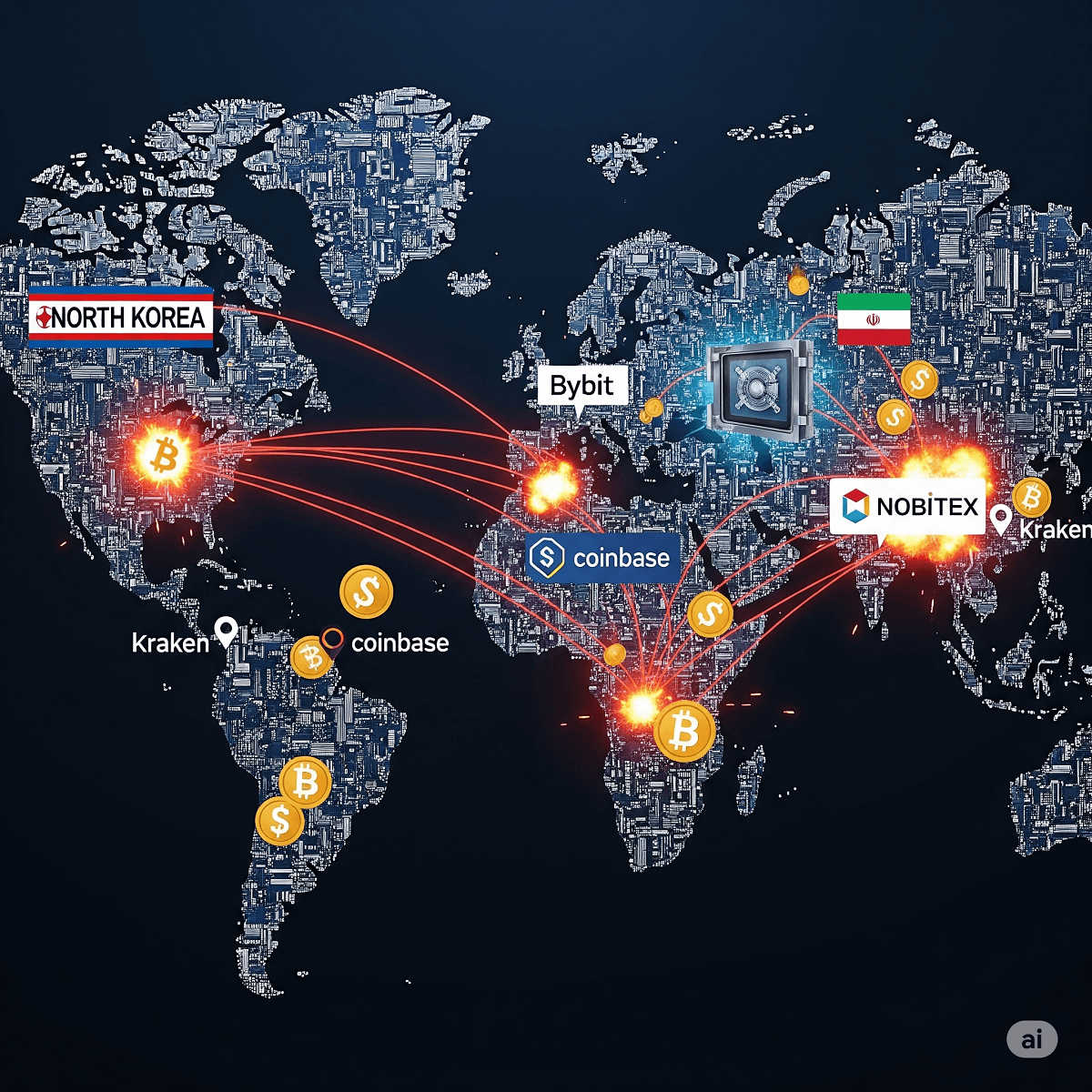

The New Face of Crypto Crime: Geopolitics Meets Cybertheft

Gone are the days when hackers were merely opportunistic thieves chasing quick profits. Today’s attacks are strategic, sophisticated, and often state-sponsored.

“As digital assets play a bigger role in global finance and national security, the attacks have evolved,” explains TRM Labs’ latest report. “We’re no longer just fighting crime—we’re navigating a battlefield where cyberattacks are tools of economic warfare.”

The Attack That Changed Everything: Bybit’s $1.5 Billion Nightmare

The defining moment of 2025 came in February, when Bybit, one of the world’s largest crypto exchanges, was drained of $1.5 billion in a single breach. This single incident accounted for 70% of all losses in the first half of the year, catapulting the average hack size to $30 million—double what it was just a year prior.

Yet, as shocking as the Bybit heist was, it was far from an isolated incident. Even excluding that mammoth theft, hackers still made off with roughly $100 million per month, proving that no platform—big or small—is truly safe.

The Rise of State-Sponsored Hackers

Perhaps the most alarming trend? Nation-states are now the biggest players in crypto crime.

Leading the charge: North Korean cybercriminals, responsible for a jaw-dropping $1.6 billion in stolen funds—70% of the total. Their motives? Evading international sanctions, funding nuclear programs, and turning cryptocurrency into a weapon of economic strategy.

But they’re not alone.

- In June 2025, a group called Gonjeshke Darande—linked to Israel—reportedly hacked Iran’s largest exchange, Nobitex, stealing $90 million. The attackers claimed they were targeting a critical pipeline for sanctions evasion and illicit funding.

- Other governments have also entered the fray, using cyberattacks to destabilize adversaries and finance covert operations.

How Are They Doing It? The Two Deadliest Attack Strategies

1. Infrastructure Hacks: The Weakest Link

Over 80% of losses came from attacks on exchange infrastructure—stealing private keys, manipulating user interfaces, or exploiting insider access. Many breaches relied on social engineering, tricking employees into granting access or revealing critical credentials.

“The weakest link in crypto security isn’t the code—it’s the people,” notes TRM Labs.

2. Protocol Exploits: The Smart Contract Trap

While less common (accounting for 12% of thefts), smart contract vulnerabilities remain a lucrative target. Hackers continue to find loopholes in DeFi protocols, draining millions before developers can patch the flaws.

What Comes Next? A Call for Global Defense

The $2 billion question: How can the crypto industry fight back?

Experts argue that security must evolve beyond technical safeguards—it needs geopolitical awareness.

- Stronger international cooperation to track and freeze stolen funds.

- Enhanced regulatory frameworks to hold state-sponsored hackers accountable.

- Better employee training to prevent social engineering attacks.

One thing is clear: The rules of the game have changed. Crypto isn’t just a financial frontier anymore—it’s a digital warzone. And if 2025’s first half is any indication, the battle is only getting started.

What do you think? Should governments treat crypto hacks as acts of cyber warfare? Share your thoughts below.