Former SEC Counsel Explains What It Takes to Make RWAs Compliant

Key Takeaways

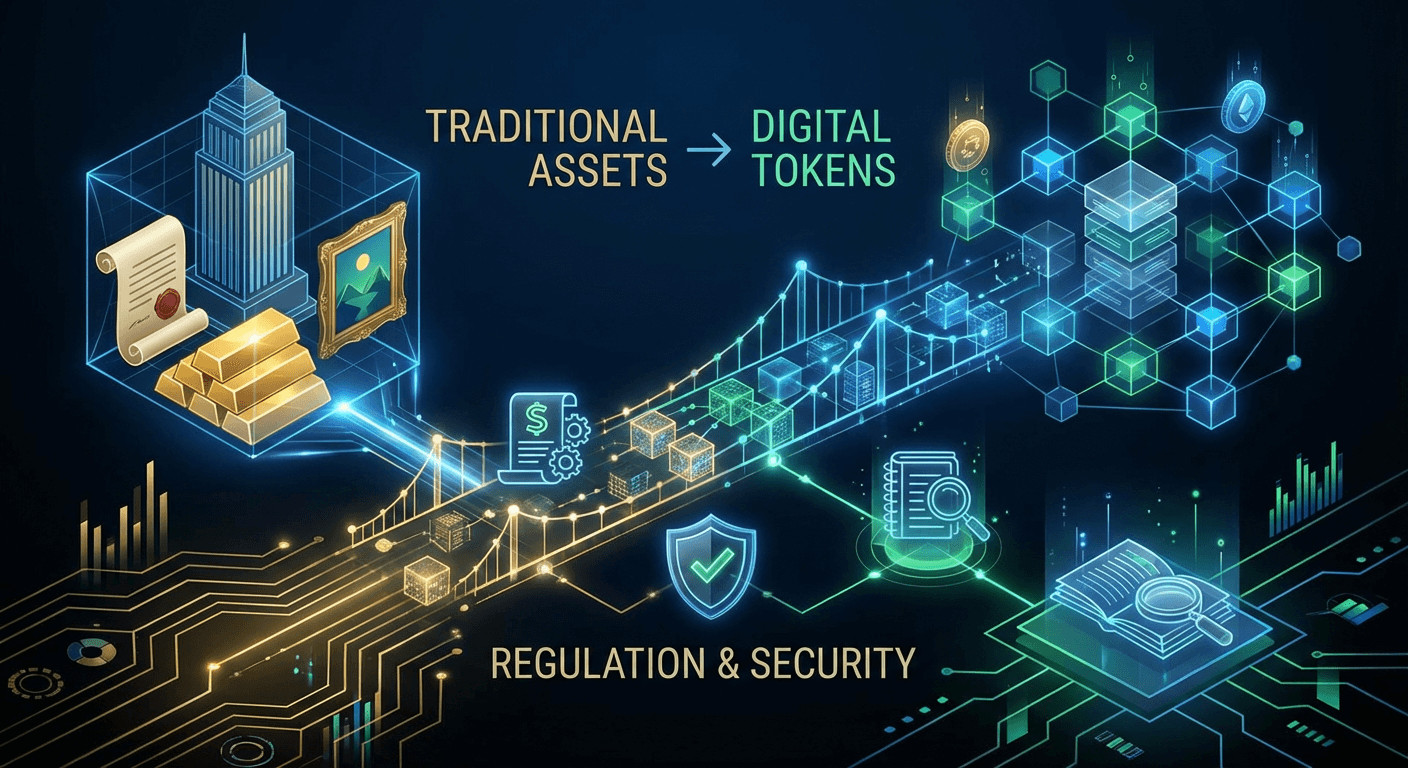

- Real-World Assets (RWAs) bridge traditional finance and blockchain, offering benefits like increased liquidity and fractional ownership by tokenizing tangible and intangible assets.

- Regulatory compliance, particularly with the U.S. SEC, is paramount for the growth and mainstream adoption of RWAs, despite the SEC’s evolving, more focused approach.

- Significant challenges to RWA compliance include complex jurisdictional issues due to the global nature of blockchain and yield constraints arising from the tension between attractive returns and stringent regulatory requirements.

- Blockchain technology, with its immutable ledger, smart contracts, and programmability, is the fundamental engine driving the transformation of RWAs, enhancing transparency, efficiency, and security.

- Compliant RWA tokenization promises profound gains in business efficiency, fosters new models for digital transformation, and expands financial innovation by democratizing investment and creating new capital formation mechanisms.

Table of Contents

- The Dawn of Digital Assets: Understanding Real-World Assets (RWAs)

- Navigating the Regulatory Labyrinth: The SEC’s Evolving Stance

- Key Hurdles to Compliance: Jurisdictional and Yield Constraints

- Blockchain: The Engine of RWA Transformation

- Connecting RWAs to Business Efficiency, Digital Transformation, and Financial Innovation

- Frequently Asked Questions (FAQ)

- Conclusion: The Future is Compliant Tokenization

The burgeoning landscape of digital assets continues to redefine traditional finance, with Real-World Assets (RWAs) emerging as a pivotal bridge between the blockchain and conventional markets. As institutions, entrepreneurs, and investors increasingly eye the tokenization of tangible and intangible assets, the question of regulatory compliance looms large. Indeed, the ability to make RWAs compliant is not merely a legal hurdle but the very key to unlocking their immense potential. Recent insights from a former SEC counsel highlight the complex path ahead, revealing that while the SEC’s evolving stance shows promise for RWA growth, significant jurisdictional and yield constraints continue to limit the development of truly compliant models.

This deep dive explores the intricacies of RWA tokenization, the regulatory gauntlet laid down by bodies like the SEC, and the transformative power of blockchain in shaping the future of asset ownership and investment. For business professionals, entrepreneurs, and crypto enthusiasts alike, understanding these dynamics is crucial for navigating the next wave of digital transformation and financial innovation.

The Dawn of Digital Assets: Understanding Real-World Assets (RWAs)

Real-World Assets (RWAs) represent tangible or intangible assets from the traditional financial world that are brought onto a blockchain. This process, known as tokenization, transforms ownership rights or economic interests in these assets into digital tokens that can be managed, traded, and settled on a distributed ledger. Examples of RWAs span a vast spectrum: from physical assets like real estate, fine art, gold, and commodities, to financial instruments such as bonds, equities, invoices, and even intellectual property or carbon credits.

The allure of RWAs lies in their ability to inject the benefits of blockchain technology into illiquid, often exclusive, traditional markets. By tokenizing these assets, we unlock several transformative advantages:

- Increased Liquidity: Traditionally illiquid assets, such as a fractional share in a commercial building or a rare piece of art, can become easily tradable on secondary markets.

- Fractional Ownership: Tokenization allows assets to be divided into smaller, more affordable units, democratizing access to high-value investments for a broader range of investors.

- Transparency and Auditability: Blockchain’s immutable ledger provides a transparent and verifiable record of ownership and transactions, enhancing trust and reducing fraud.

- Operational Efficiency: Smart contracts can automate various processes, from dividend distribution to transfer restrictions, significantly reducing administrative costs and settlement times.

- Global Accessibility: Digital tokens can be traded across borders 24/7, opening up new investment opportunities and market access for participants worldwide.

For businesses, tokenizing RWAs isn’t just about financial innovation; it’s a profound step in digital transformation. It offers new avenues for capital formation, optimizes asset management, and can streamline complex operational workflows that have historically been bogged down by intermediaries and manual processes. Imagine a world where supply chain financing is automated through tokenized invoices, or where real estate transactions settle in minutes, not weeks. This is the promise of RWAs.

Navigating the Regulatory Labyrinth: The SEC’s Evolving Stance

The U.S. Securities and Exchange Commission (SEC) plays a critical role in shaping the regulatory landscape for digital assets, particularly those that resemble traditional securities. The core challenge for tokenized RWAs often revolves around whether the digital token itself constitutes a “security” under U.S. law, typically assessed using the Howey Test. If a token is deemed a security, it must comply with stringent registration, disclosure, and operational requirements designed to protect investors.

The former SEC counsel’s observation that the “SEC’s changing approach to crypto is supporting RWA growth” is a nuanced but significant statement. Historically, the SEC has taken a cautious, often enforcement-led approach to crypto, viewing many digital assets as unregistered securities. However, increased institutional interest, the collapse of certain unregulated crypto entities, and the growing maturity of blockchain technology appear to be prompting a more focused, albeit still stringent, dialogue around how to safely integrate digital assets into the existing financial framework.

This “changing approach” isn’t necessarily a relaxation of rules but rather a recognition of the permanence and potential of tokenized assets. It suggests a move towards providing clearer guidelines or a willingness to engage with industry participants to develop compliant models. The SEC is grappling with the fundamental question of how to apply existing securities laws, designed for a different era, to novel digital instruments. For RWAs to truly flourish, this evolving perspective must translate into practical, executable frameworks that businesses can confidently adopt. Without clear regulatory pathways, the risk of legal challenges and the associated reputational damage can stifle innovation and deter mainstream adoption.

Key Hurdles to Compliance: Jurisdictional and Yield Constraints

Despite the burgeoning interest and the SEC’s shifting dialogue, two major obstacles stand in the way of widespread, compliant RWA adoption: jurisdictional complexity and yield constraints.

Jurisdictional Complexity: A Global Quagmire

The digital nature of blockchain transactions means they transcend physical borders, but the assets they represent (RWAs) and the regulations governing them remain tied to specific national or regional laws. This creates a significant jurisdictional headache.

- Governing Law: If a property in London is tokenized on a blockchain managed by a company in Singapore, and the tokens are traded by investors in New York and Dubai, which jurisdiction’s laws apply in case of a dispute or default? The enforceability of smart contracts and digital ownership across diverse legal systems is far from settled.

- Asset Location vs. Token Location: The physical asset remains in a specific country, subject to its property, tax, and corporate laws. The digital token, however, exists on a global, permissionless network (or a permissioned one that still spans multiple jurisdictions). Reconciling these two realities requires innovative legal frameworks and potentially international cooperation.

- Licensing and Registration: Different jurisdictions have varying requirements for issuing, listing, and trading securities or other financial instruments. A platform tokenizing RWAs might need multiple licenses to operate globally, significantly increasing operational complexity and cost.

- Enforcement: In the event of a breach or a need to assert ownership rights, how would legal action be taken, and which courts would have jurisdiction? The legal recourse for token holders tied to a physical asset in a foreign country can be convoluted and expensive.

Addressing jurisdictional challenges requires a multi-pronged approach: clear legal opinions for each specific RWA offering, robust legal structures (e.g., using special purpose vehicles in specific jurisdictions), and ongoing efforts to develop international standards or harmonized regulatory approaches for digital assets. For businesses, this means meticulous due diligence and a deep understanding of the legal frameworks in all relevant geographies.

Expert Take: The Global Regulatory Patchwork

“The true challenge for global RWA tokenization isn’t just about one regulator, but about stitching together a coherent legal narrative across dozens of sovereign jurisdictions. Without legal interoperability, enforceability remains a significant bottleneck, especially for cross-border investments where the underlying asset and the token holder reside in different regulatory spheres.” – Former SEC Counsel (Inferred insight)

Yield Constraints: The Balance Between Innovation and Regulation

The second major hurdle relates to “yield constraints,” which often arise from the inherent tension between regulatory requirements and the desire to offer attractive returns or features common in decentralized finance (DeFi).

- Securities Offering Restrictions: If a tokenized RWA is deemed a security, offering competitive yields might trigger additional regulatory scrutiny or registration requirements. For instance, promising a fixed return on an RWA could classify it as an interest-bearing security, subject to strict rules.

- DeFi Integration Limitations: Many crypto investors are drawn to the high yields available in DeFi protocols (e.g., lending, staking). Integrating compliant RWAs into these protocols can be challenging. Regulated RWAs often require KYC/AML (Know Your Customer/Anti-Money Laundering) checks and accredited investor status, which clash with the permissionless nature of many DeFi applications.

- Underlying Asset Yield: The yield of a tokenized RWA is fundamentally tied to the yield of the underlying physical asset. While tokenization can increase liquidity, it doesn’t inherently increase the asset’s intrinsic yield. Regulations might limit how additional yield can be generated or distributed through the token structure without creating new compliance burdens.

- Marketing and Investor Protection: Regulators are wary of offerings that promise unrealistic returns, especially to retail investors. The need to balance marketing the benefits of tokenization with transparently disclosing risks and realistic yield expectations is crucial for compliant models.

Overcoming yield constraints involves innovative structuring that aligns regulatory compliance with investor expectations. This could mean designing tokenized products that offer yield in a compliant manner (e.g., through rental income from tokenized real estate, or dividends from tokenized equities), or creating separate, regulated pathways for institutional participation in DeFi-like activities involving RWAs.

Expert Take: The Yield vs. Compliance Conundrum

“While the promise of RWA tokenization is vast, the ability to generate compelling yields often bumps up against strict securities laws, especially concerning retail investors. Crafting compliant RWA offerings requires innovative financial engineering that balances attractive returns with robust investor protection and adherence to registration requirements.” – Former SEC Counsel (Inferred insight)

Blockchain: The Engine of RWA Transformation

At the heart of RWA tokenization lies blockchain technology, providing the foundational infrastructure for this new paradigm. Its core attributes are precisely what enable the transformation of traditional assets into digital ones, driving business efficiency, digital transformation, and financial innovation.

- Immutable Ledger: Blockchain’s unchangeable record of transactions ensures the integrity and security of RWA ownership, eliminating disputes over provenance and history. This transparency builds trust, a critical factor for attracting institutional capital.

- Smart Contracts: These self-executing contracts automate the terms of an agreement directly onto the blockchain. For RWAs, smart contracts can manage everything from fractional ownership distribution, dividend payments, voting rights, and even automated compliance checks (e.g., ensuring only approved wallets can hold certain tokens). This radically optimizes operational workflows by reducing manual intervention and intermediaries.

- Decentralization/Distribution: While some RWA solutions might utilize permissioned blockchains for enhanced control and compliance, the distributed nature still reduces single points of failure and enhances resilience. It also allows for efficient and secure sharing of data among authorized participants.

- Programmable Assets: Tokens representing RWAs are programmable, meaning they can be endowed with specific rules and functionalities. This allows for tailored financial products, automated compliance features, and dynamic management of asset rights.

- Interoperability: As blockchain technology matures, interoperability between different networks (e.g., public and private blockchains) will further enhance the liquidity and reach of tokenized RWAs, connecting disparate ecosystems.

By leveraging blockchain, businesses can streamline their asset management processes, create new financial products, and achieve levels of operational optimization previously unattainable. From faster settlement times in real estate to automated royalty payments for intellectual property, blockchain is the digital backbone for a more efficient and transparent financial future.

Connecting RWAs to Business Efficiency, Digital Transformation, and Financial Innovation

The implications of compliant RWA tokenization extend far beyond mere technological novelty. They represent a fundamental shift in how businesses operate, how finance functions, and how digital transformation is realized.

Business Efficiency and Operational Optimization

Tokenized RWAs offer significant gains in efficiency by:

- Reducing Intermediaries: Blockchain’s disintermediating power cuts out layers of brokers, custodians, and legal firms, leading to lower transaction costs and faster processing.

- Automating Processes: Smart contracts automate complex procedures like asset transfers, payment distributions, and compliance checks, minimizing human error and operational overhead.

- Faster Settlement: Traditional asset settlements can take days; blockchain can reduce this to minutes or seconds, freeing up capital and improving cash flow for businesses.

- Enhanced Auditability and Reporting: The transparent and immutable nature of blockchain transactions simplifies auditing and regulatory reporting, reducing compliance costs and increasing investor confidence.

For a corporation looking to optimize its balance sheet, tokenizing illiquid assets can unlock capital. For a real estate developer, it can accelerate sales cycles and reduce administrative burdens. The operational benefits are tangible and directly impact the bottom line.

Digital Transformation and New Business Models

RWAs are a cornerstone of enterprise digital transformation initiatives, moving companies from legacy systems to Web3-native paradigms.

- New Investment Products: Tokenization allows for the creation of innovative financial instruments that bundle assets, offer structured products, or provide access to previously inaccessible markets.

- Fractional Ownership Platforms: Entire new business models are emerging around platforms that enable fractional ownership of high-value assets, democratizing access for retail investors while providing new funding avenues for asset owners.

- Supply Chain Finance: Tokenized invoices or purchase orders can streamline supply chain financing, making capital more accessible to small and medium-sized enterprises (SMEs) and improving overall supply chain resilience.

- Decentralized Autonomous Organizations (DAOs): RWAs can be managed or governed by DAOs, allowing for community-driven decision-making and transparency in asset management, creating new forms of corporate governance.

These developments enable businesses to not just digitize existing processes but to fundamentally rethink their value propositions and operational structures in a digital-first world.

Financial Innovation and Market Expansion

The tokenization of RWAs represents a profound leap in financial innovation:

- Democratization of Investment: By lowering entry barriers through fractional ownership, tokenized RWAs can bring a new cohort of investors into markets previously exclusive to institutions and high-net-worth individuals.

- Increased Market Depth and Liquidity: New secondary markets for tokenized assets enhance liquidity, allowing investors to enter and exit positions more easily, potentially increasing overall market depth and stability.

- Integration with DeFi: While challenging, compliant integration of RWAs with DeFi protocols could unlock vast pools of capital and create novel financial applications, blending the best of traditional finance with the innovation of decentralized finance. Imagine using a tokenized bond as collateral in a DeFi lending protocol.

- New Capital Formation Mechanisms: Companies can raise capital by issuing security tokens representing shares, bonds, or revenue streams, potentially at lower costs and with broader investor reach than traditional fundraising methods.

This confluence of technology and finance opens up entirely new financial paradigms, creating opportunities for entrepreneurs to build, investors to diversify, and traditional financial institutions to innovate.

Frequently Asked Questions (FAQ)

What are Real-World Assets (RWAs)?

RWAs are tangible or intangible assets from traditional finance (like real estate, bonds, art) that are brought onto a blockchain through tokenization, transforming ownership or economic interests into digital tokens.

Why is regulatory compliance important for RWAs?

Compliance, especially with bodies like the SEC, is crucial because if a token is deemed a security, it must adhere to stringent registration, disclosure, and operational requirements, which is key to unlocking its potential and ensuring investor protection.

What are the main challenges to RWA compliance?

The two major obstacles are jurisdictional complexity (applying diverse national laws to global digital assets) and yield constraints (balancing attractive returns with stringent regulatory requirements).

How does blockchain technology facilitate RWAs?

Blockchain provides an immutable ledger, smart contracts for automation, decentralization for resilience, and programmable assets, all of which enhance transparency, efficiency, and security for tokenized assets.

What are the business benefits of RWA tokenization?

RWAs offer increased business efficiency through reduced intermediaries and automated processes, drive digital transformation with new business models like fractional ownership, and foster financial innovation by democratizing investment and expanding market depth.

Conclusion: The Future is Compliant Tokenization

The insights from the former SEC counsel underscore a critical truth: the future of Real-World Assets on the blockchain is inextricably linked to robust, transparent, and enforceable regulatory compliance. While the SEC’s evolving approach signals a growing acceptance and understanding of digital assets, the path to mainstream adoption is fraught with challenges, particularly concerning jurisdictional complexities and the intricacies of yield generation within regulatory boundaries.

For business professionals and entrepreneurs, the message is clear: the opportunity presented by RWA tokenization is immense, promising unprecedented levels of business efficiency, digital transformation, and financial innovation. However, unlocking this potential requires a proactive and meticulous approach to compliance. Engaging with legal experts, understanding the nuances of global regulations, and designing tokenization models that are both innovative and compliant will be paramount.

As blockchain technology continues to mature and regulatory clarity slowly emerges, the vision of a world where all valuable assets are seamlessly tokenized and traded on transparent, efficient networks moves closer to reality. The journey to make RWAs truly compliant is a complex one, but it is a journey that will ultimately redefine the very fabric of our financial and economic systems. Those who navigate this path successfully will not only reap significant rewards but will also play a pivotal role in shaping the digital economy of tomorrow.