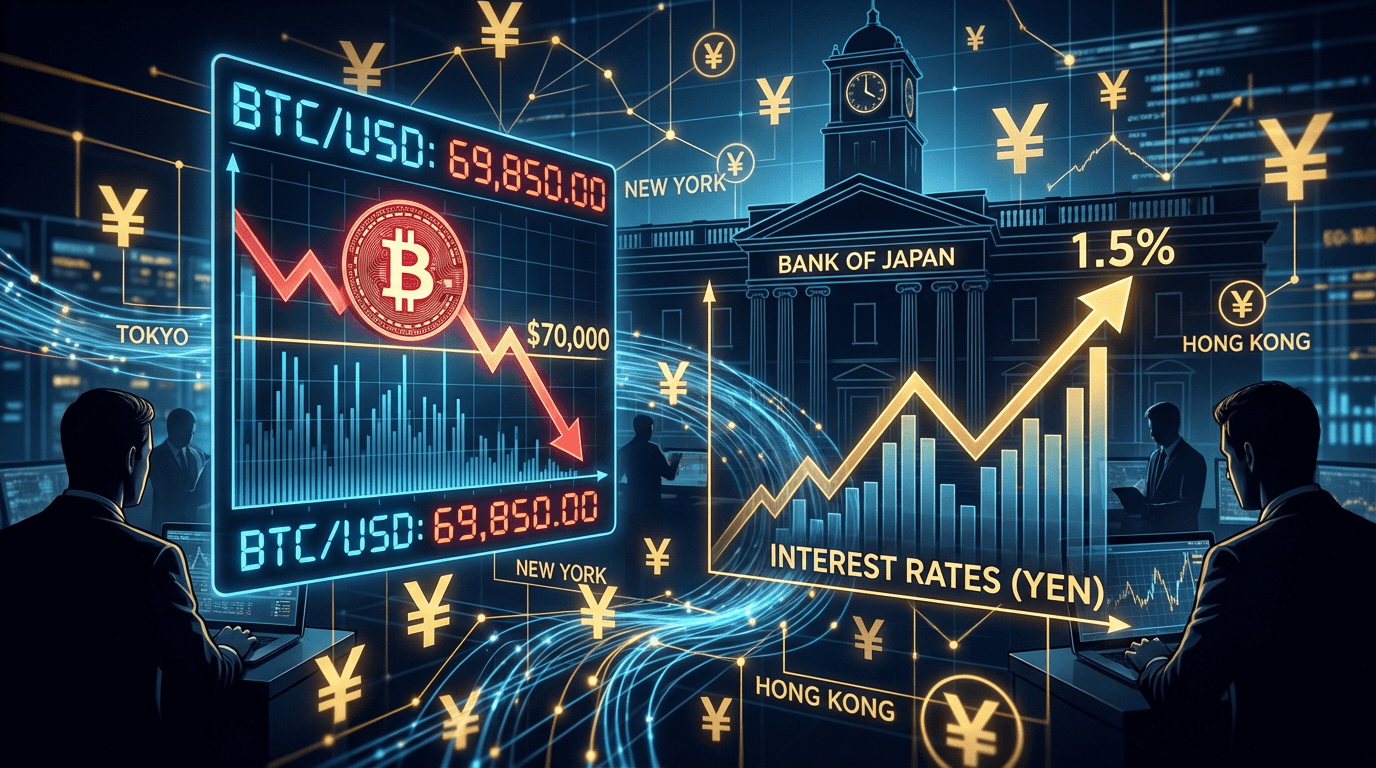

Bitcoin Will ‘Dump Below $70K’ Thanks to Hawkish Japan: Macro Analysts

Key Takeaways

- Bitcoin’s price is forecast to dip below $70,000, primarily influenced by an anticipated hawkish shift from the Bank of Japan (BOJ).

- The BOJ’s expected interest rate hike will likely unwind “Japanese Yen Carry Trades,” significantly reducing global liquidity and impacting riskier assets like cryptocurrencies.

- Bitcoin largely functions as a risk asset, closely correlating with global liquidity; thus, tightening monetary policies create downward pressure on its value.

- For businesses and entrepreneurs, understanding these macroeconomic shifts is crucial for strategic foresight in digital transformation, financial innovation, and treasury management.

- Despite short-term price volatility, the fundamental value and transformative potential of blockchain technology for enhancing business efficiency and creating new models remain robust.

Table of Contents

The world of digital assets, particularly Bitcoin, has long been praised for its decentralization and supposed independence from traditional financial systems. However, as the cryptocurrency market matures and integrates further into the global economy, it becomes increasingly susceptible to macroeconomic forces that dictate the flow of capital worldwide. A recent forecast by macro analysts suggests that Bitcoin could experience a significant downturn, potentially dumping below $70,000, primarily influenced by an anticipated hawkish shift from the Bank of Japan (BOJ). This development underscores a critical reality for business professionals, entrepreneurs, and crypto enthusiasts: understanding global monetary policy is no longer optional but essential for navigating the volatile yet promising digital asset landscape.

The Bank of Japan, a major player in global finance, is expected to increase its benchmark interest rates soon, a move that historically signals a bearish outlook for riskier assets such as cryptocurrencies. This isn’t merely a localized event; the BOJ’s policy adjustments often ripple through international markets, affecting everything from equity prices to commodity futures and, increasingly, digital assets. For businesses leveraging blockchain solutions, engaging in digital transformation, or exploring financial innovation through crypto, these shifts demand close attention and strategic foresight.

The Bank of Japan’s Influence: A Deep Dive into Monetary Policy

To grasp the potential impact on Bitcoin, it’s crucial to understand the BOJ’s unique position and the mechanics of its monetary policy. For decades, Japan has maintained an ultra-loose monetary stance, characterized by near-zero or negative interest rates and aggressive quantitative easing (QE). This approach was primarily aimed at combating deflation and stimulating economic growth in a country grappling with an aging population and persistent economic stagnation.

Understanding Hawkish vs. Dovish Monetary Policy

Monetary policy can be broadly categorized as either “hawkish” or “dovish.”

- Dovish Policy: This involves measures designed to stimulate economic growth, such as lowering interest rates, quantitative easing (printing money to buy government bonds and other assets), and providing ample liquidity to financial markets. The goal is to encourage borrowing, spending, and investment.

- Hawkish Policy: Conversely, a hawkish stance aims to curb inflation and cool down an overheating economy. This typically involves raising interest rates, quantitative tightening (reducing the money supply by selling off assets), and withdrawing liquidity from the market. Higher interest rates make borrowing more expensive, which can reduce consumer and business spending.

The BOJ has been a staunch advocate of dovish policies for an extended period, maintaining the lowest interest rates among major global economies. This policy has had significant global ramifications, particularly in the realm of “carry trades.”

The Japanese Yen Carry Trade and its Global Impact

The low interest rates in Japan have historically fueled a phenomenon known as the Japanese Yen Carry Trade. This involves investors borrowing Japanese Yen at very low interest rates and then converting that Yen into higher-yielding currencies (like the US Dollar or Euro) or investing in higher-yielding assets (like emerging market stocks, real estate, or even riskier assets like Bitcoin). The difference in interest rates, or the “carry,” generates profit for the investor. This practice injects significant liquidity into global markets, as borrowed Yen flows out and gets invested elsewhere.

When the Bank of Japan shifts to a hawkish stance and begins to raise interest rates, it makes borrowing Yen more expensive and reduces the attractiveness of the carry trade. Investors who have engaged in these trades might start to unwind them, selling off their higher-yielding assets and buying back Yen to repay their loans. This process can lead to a significant withdrawal of liquidity from global markets, creating downward pressure on a wide range of assets, including riskier ones like Bitcoin. The anticipated BOJ rate hike on Friday, as mentioned by macro analysts, is seen as the catalyst for such an unwinding, leading to the prediction of Bitcoin dipping below $70,000.

Yield Curve Control (YCC) and its Abandonment

Another critical aspect of the BOJ’s dovish policy has been its Yield Curve Control (YCC). This policy involved the BOJ actively buying government bonds to keep long-term interest rates (specifically, the yield on 10-year Japanese government bonds) at a specific target level. YCC was an unprecedented measure designed to anchor borrowing costs and further stimulate the economy. The gradual dismantling or abandonment of YCC, which the BOJ has signaled, represents a significant shift towards normalization and further reinforces a hawkish pivot. When YCC is abandoned, bond yields are allowed to rise, reflecting market forces, which can further strengthen the Yen and accelerate the unwinding of carry trades.

Bitcoin and Risk Assets: The Correlation with Global Liquidity

Bitcoin, despite its proponents’ arguments for its status as “digital gold” or an inflation hedge, has largely behaved as a risk asset in recent years. This means its price tends to move in correlation with other speculative investments, such as growth stocks and emerging market equities. When global liquidity is abundant and interest rates are low, investors are more willing to take on risk, pouring capital into assets with higher potential returns, including Bitcoin. Conversely, when liquidity tightens, and interest rates rise, investors become more risk-averse, pulling capital out of speculative assets and moving towards safer havens or fixed-income investments.

The $70,000 level for Bitcoin is not just an arbitrary number; it represents a significant psychological and technical support/resistance level that has been a focal point for market participants. A breach below this level, particularly due to such fundamental macroeconomic shifts, would signal a notable change in market sentiment and potentially trigger further selling pressure.

Expert Takes: The Macro View on Bitcoin’s Trajectory

Leading macro analysts and market observers have been increasingly highlighting the interconnectedness of global financial policies and the crypto market. The consensus view, as reflected in the Cointelegraph report, points to a direct causal link between the BOJ’s expected policy shift and Bitcoin’s near-term price action.

“The anticipated hawkish pivot from the Bank of Japan represents a significant macroeconomic headwind for risk assets globally. As the unwinding of Yen carry trades gathers momentum, we expect a broad reduction in global liquidity, which historically places downward pressure on speculative investments, including Bitcoin. A sustained dip below the $70,000 threshold for Bitcoin would be a direct consequence of this tightening monetary environment, signaling a more cautious investor sentiment.” – Leading Macro Analysts, as cited by Cointelegraph.

This perspective underscores that even assets designed to operate outside traditional financial structures are not immune to the gravitational pull of major central bank actions. For those involved in crypto, understanding this dynamic is paramount.

Connecting Crypto and Web3 Developments to Business Strategy

For business professionals, entrepreneurs, and executives, the implications of these macroeconomic shifts extend far beyond mere price speculation. They touch upon critical aspects of digital transformation, financial innovation, and operational optimization.

Digital Transformation and Blockchain Adoption

Volatility in crypto markets, while challenging, does not diminish the underlying value proposition of blockchain technology for digital transformation. Businesses are increasingly adopting blockchain for:

- Supply Chain Transparency: Enhancing visibility and traceability of goods from origin to consumer.

- Secure Data Management: Utilizing decentralized ledgers for immutable record-keeping and enhanced data integrity.

- Tokenization of Assets: Representing real-world assets (real estate, art, commodities) as digital tokens, enabling fractional ownership and increased liquidity.

While a Bitcoin price dip might momentarily dampen enthusiasm for some speculative aspects of crypto, it does not invalidate the long-term strategic advantage of integrating blockchain into core business processes. Instead, it offers a crucial reminder to separate the speculative asset from the transformative technology. Companies focused on building robust, scalable blockchain solutions should view these periods as opportunities to solidify their foundations, attract talent, and innovate without the distraction of exuberant market bubbles.

Financial Innovation and Treasury Management

For businesses that have already embraced digital assets for treasury management or cross-border payments, understanding macroeconomic forces becomes vital for risk mitigation.

- Treasury Management: Companies holding cryptocurrencies as part of their treasury need to account for potential depreciation due due to macro events. Diversification, hedging strategies, and robust risk frameworks are essential. This is not just about avoiding losses, but optimizing capital allocation and ensuring financial stability.

- Cross-Border Payments: Blockchain-based payment solutions offer unparalleled efficiency, speed, and lower costs compared to traditional systems. However, the volatility introduced by macro factors can affect the value of transferred assets between initiation and settlement, requiring businesses to implement real-time conversion mechanisms or stablecoin utilization to mitigate currency risk.

- DeFi and Lending: Businesses exploring decentralized finance (DeFi) protocols for lending, borrowing, or yield generation must factor in global interest rate environments. As traditional interest rates rise, the appeal of DeFi yields might fluctuate, and the cost of capital in certain DeFi protocols could also change.

Operational Optimization and Strategic Planning

Navigating a crypto market influenced by central bank decisions requires businesses to integrate macroeconomic analysis into their strategic planning.

- Market Entry and Product Development: For startups and established companies entering the Web3 space, understanding the timing of market cycles relative to global monetary policy can inform product launch strategies, funding rounds, and target market engagement. A period of market cooling, induced by hawkish policies, might be an opportune time for building and developing foundational infrastructure rather than focusing solely on market hypes.

- Investor Relations and Funding: Crypto-native companies seeking funding or engaging with investors must be prepared to articulate how their business models are resilient to market volatility driven by macro factors. A strong narrative around fundamental value, technological innovation, and sustainable growth becomes even more critical during such periods.

- Talent Acquisition: While a market downturn might affect speculative investments, the demand for skilled blockchain developers, crypto economists, and Web3 strategists continues to grow. Businesses committed to the long-term vision of Web3 can use these periods to attract top talent who prioritize innovation over short-term gains.

The Enduring Value of Blockchain Solutions

Despite the immediate concerns about Bitcoin’s price trajectory, it’s critical to underscore that the underlying blockchain technology and the broader Web3 movement continue to advance rapidly. The value proposition of decentralized, transparent, and efficient digital systems remains undiminished.

- Enhanced Business Efficiency: Blockchain offers unparalleled efficiency in areas like contract management (smart contracts), supply chain logistics, identity verification, and data sharing. These efficiencies translate into cost savings, reduced fraud, and improved operational workflows, regardless of Bitcoin’s price.

- New Revenue Streams and Business Models: Web3 introduces novel concepts like tokenization, NFTs, DAOs (Decentralized Autonomous Organizations), and the metaverse, creating entirely new markets and business models. These innovations allow for direct creator-consumer interactions, new forms of digital ownership, and community-driven governance, unlocking economic value that was previously unattainable.

- Financial Inclusion and Accessibility: Cryptocurrencies, particularly stablecoins and central bank digital currencies (CBDCs), hold the potential to democratize finance, providing access to banking services, credit, and investment opportunities for underserved populations globally. This extends financial innovation beyond traditional institutions.

For businesses, the focus must remain on the long-term strategic advantages of adopting and integrating these technologies. While Bitcoin might experience short-term fluctuations due to a hawkish Bank of Japan, the fundamental shift towards a more decentralized, digitally-native global economy powered by blockchain is an irreversible trend.

FAQ

What is the Bank of Japan’s anticipated shift and how will it impact Bitcoin?

The Bank of Japan is expected to move from an ultra-loose monetary policy to a hawkish stance by raising benchmark interest rates. This shift will likely lead to an unwinding of the “Japanese Yen Carry Trade,” causing a significant withdrawal of global liquidity from riskier assets, including Bitcoin, potentially pushing its price below $70,000.

What is the Japanese Yen Carry Trade?

The Japanese Yen Carry Trade involves investors borrowing Yen at very low interest rates and then investing that capital into higher-yielding assets or currencies elsewhere in the world. When the BOJ raises rates, this trade becomes less profitable, prompting investors to sell off assets and buy back Yen, reducing global liquidity.

Why is Bitcoin considered a “risk asset” in this context?

Despite claims of being “digital gold,” Bitcoin has increasingly behaved like a risk asset, correlating with other speculative investments such as growth stocks. When global liquidity tightens due to rising interest rates, investors tend to pull capital from riskier assets, putting downward pressure on Bitcoin’s price.

How should businesses leveraging blockchain adapt to these macroeconomic shifts?

Businesses must integrate robust macroeconomic analysis into their strategies. This includes diversifying cryptocurrency holdings in treasury management, implementing real-time conversion mechanisms for cross-border payments to mitigate volatility, and adapting product development and funding strategies to market cycles influenced by global monetary policy.

Does Bitcoin’s price volatility diminish the long-term value of blockchain technology?

No, the underlying value proposition of blockchain technology remains strong. While Bitcoin’s price might fluctuate due to macro factors, blockchain continues to offer significant advantages for digital transformation, supply chain transparency, secure data management, and the creation of new business models through Web3 innovations, irrespective of short-term market movements.

Conclusion: Navigating Macro Headwinds with Strategic Vision

The anticipated move by the Bank of Japan to raise interest rates, potentially pushing Bitcoin below $70,000, serves as a powerful reminder of the deep interconnectedness between traditional finance and the nascent digital asset ecosystem. For business professionals, entrepreneurs, and investors, this event is not merely a trading signal but a call to integrate robust macroeconomic analysis into their crypto and Web3 strategies.

Understanding the dynamics of monetary policy, the unwinding of carry trades, and the behavior of risk assets in a tightening liquidity environment is crucial for effective treasury management, risk mitigation, and strategic planning in the digital age. While short-term volatility is an inherent characteristic of emerging markets, the long-term value proposition of blockchain solutions—driving digital transformation, fostering financial innovation, and optimizing operational efficiency—remains compelling. Businesses that can adeptly navigate these macro headwinds, maintaining a focus on fundamental technology and sustainable growth, will be best positioned to thrive in the evolving landscape of cryptocurrency and Web3. The future of finance and business is undeniably digital, but its path will continue to be influenced by the powerful currents of global economic policy.

Meta Description

Discover how the Bank of Japan’s hawkish shift could push Bitcoin below $70,000 and why macro analysis is crucial for navigating crypto and Web3. Learn about carry trades, risk assets, and the enduring value of blockchain for business strategy.