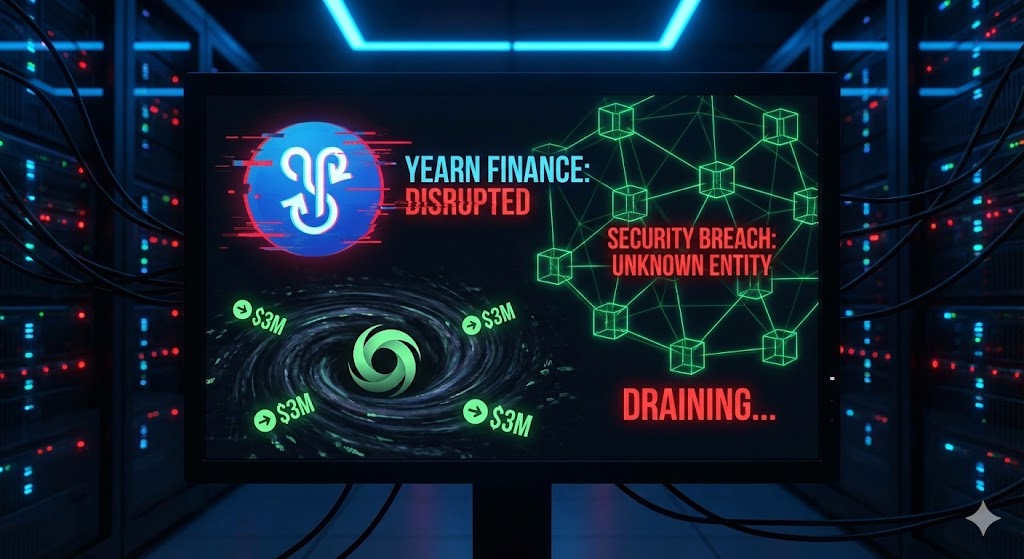

Yearn Finance’s yETH Suffers Major Hack, Attackers Send $3M ETH to Tornado Cash

Key Takeaways

- Yearn Finance’s yETH token was exploited in a sophisticated attack, resulting in $3 million in ETH being drained from Balancer liquidity pools and sent to Tornado Cash.

- The incident highlights the persistent security challenges within decentralized finance (DeFi), including smart contract vulnerabilities, composability risks, and the limitations of even rigorous security audits.

- The use of Tornado Cash by the attackers underscores the ongoing dilemma between user privacy in crypto and the regulatory imperative for anti-money laundering (AML) and know-your-customer (KYC) compliance.

- For businesses and entrepreneurs, the hack serves as a crucial case study emphasizing the need for proactive, robust security measures, advanced risk assessment, and continuous vigilance in Web3 engagements.

- Building trust in the “trustless” DeFi ecosystem requires enhanced security audits, strong bug bounty programs, community vigilance, decentralized insurance, and ongoing developer education.

Table of Contents

-

- Understanding the Exploit: A Deep Dive into the yETH Breach

- Expert Takes: The Enduring Challenge of DeFi Security

- The Broader Landscape of DeFi Security Risks

- Tornado Cash and the Anonymity Dilemma

- Connecting the Dots: Implications for Financial Innovation and Digital Transformation

- Expert Takes: Navigating the Regulatory Currents

- Building Trust in a Trustless System: Moving Forward

- FAQ Section

- Conclusion

The world of decentralized finance (DeFi) is a frontier of rapid innovation, offering unprecedented opportunities for financial efficiency, transparency, and digital transformation. However, this dynamic landscape also presents significant challenges, particularly concerning security. A stark reminder of these inherent risks emerged recently with the news that Yearn Finance’s yETH suffered a major hack, with attackers successfully sending $3 million in ETH to Tornado Cash. This incident, which saw an exploit generate a near-infinite number of yETH tokens and subsequently drain millions from Balancer liquidity pools, underscores the critical need for robust security measures, rigorous auditing, and a deep understanding of the risks associated with cutting-edge blockchain protocols. For business professionals, entrepreneurs, and anyone engaged with digital assets, this event is not merely a technical blip but a pivotal case study in the ongoing evolution of Web3 security, financial innovation, and operational risk management.

The Yearn Finance hack serves as a potent reminder that even well-established and highly regarded DeFi protocols are not immune to sophisticated exploits. Yearn Finance, a pioneering yield aggregator, plays a crucial role in the DeFi ecosystem by optimizing users’ crypto earnings through automated strategies. Its yETH token represents a share in a diversified pool of Ether-based assets, designed to maximize yield. The attack on yETH and its associated Balancer pools highlights the complex interplay of smart contracts, liquidity mechanisms, and tokenomics that, when combined with a subtle vulnerability, can lead to devastating financial losses. Understanding the mechanics of such attacks is paramount for any organization looking to leverage blockchain technology for business efficiency or integrate digital assets into their financial strategies.

Understanding the Exploit: A Deep Dive into the yETH Breach

The exploit against Yearn Finance’s yETH was sophisticated, targeting a critical vulnerability that allowed the attackers to manipulate the system to their advantage. At its core, the attack involved the illegitimate generation of a vast quantity of yETH tokens. These newly minted tokens, though fraudulent in origin, were recognized by the associated liquidity pools on Balancer, a decentralized exchange protocol that allows for custom liquidity pools. By flooding these pools with an artificially inflated supply of yETH, the attackers were able to drain legitimate Ether (ETH) from the pools, effectively converting their illicitly generated yETH into real, valuable cryptocurrency. The summary indicates that the exploit “generated a near-infinite number of Yearn Finance’s yETH,” which is a classic symptom of a minting vulnerability or an issue with how the protocol handled internal accounting or external interactions, leading to an imbalance that could be exploited.

Balancer pools are integral to DeFi, enabling users to provide liquidity for various token pairs and earn trading fees. When an attacker can manipulate the perceived value or supply of one of the tokens within such a pool, they can execute a “pool draining” attack. In this scenario, the attacker effectively trades their worthless or cheaply generated tokens for valuable tokens held by other liquidity providers in the pool, leveraging the protocol’s logic against itself. The immediate transfer of the stolen $3 million ETH to Tornado Cash, a well-known cryptocurrency mixer, further complicates efforts to trace and recover the funds, underscoring the challenges of financial forensics in the decentralized world.

Expert Takes: The Enduring Challenge of DeFi Security

The Yearn Finance incident is a sobering reminder that the “code is law” principle in DeFi also means that flaws in that code can have irreversible consequences. Industry analysts consistently emphasize that while blockchain offers unparalleled transparency in transactions, the underlying smart contract logic remains a prime target for malicious actors.

Expert Take: “The relentless pace of innovation in DeFi often outstrips the thoroughness of security auditing and vulnerability testing. Projects, even established ones like Yearn, must prioritize continuous security assessments, bug bounties, and formal verification methods to safeguard user funds against increasingly sophisticated attack vectors.” – Crypto Security Analyst Collective

This sentiment highlights the ongoing tension between rapid deployment of new financial primitives and the imperative of ironclad security. The complexity of DeFi protocols, which often interact with multiple other protocols (e.g., Yearn interacting with Balancer), creates a vast attack surface where a vulnerability in one component can cascade through the entire integrated system.

The Broader Landscape of DeFi Security Risks

The Yearn Finance hack is not an isolated incident but rather a recurring theme in the history of DeFi. The industry has witnessed numerous exploits, ranging from flash loan attacks that manipulate oracle prices to re-entrancy bugs that allow repeated withdrawals. These incidents collectively illustrate several critical aspects of DeFi security:

- Smart Contract Vulnerabilities: The core of most DeFi protocols lies in smart contracts—self-executing code stored on a blockchain. Flaws in this code, whether logic errors, re-entrancy issues, or improper handling of external calls, can be exploited.

- Composability Risks: DeFi protocols are designed to be “money legos,” building upon each other. While this composability fosters innovation, it also means that a vulnerability in one protocol can expose others that interact with it. The yETH/Balancer interaction is a prime example.

- Audits are Not a Panacea: While security audits by reputable firms are crucial, they are not foolproof. Audits provide a snapshot of security at a given time and might miss subtle, complex vulnerabilities, especially as protocols evolve and integrate new features.

- Economic Exploits: Beyond pure code bugs, some exploits leverage the economic design of a protocol. Manipulating token prices or liquidity ratios, as seen in many flash loan attacks, falls into this category. The yETH exploit likely had an economic component once the token supply was manipulated.

- Lack of Centralized Recourse: Unlike traditional finance, where central authorities or insurance mechanisms often protect users against fraud or system failures, DeFi’s decentralized nature means that stolen funds are often irrecoverable, emphasizing the user’s responsibility for due diligence.

These risks pose significant questions for businesses and entrepreneurs considering deeper engagement with Web3. While the promise of decentralized finance—lower costs, increased transparency, and greater financial inclusion—is compelling, the operational risks must be thoroughly understood and mitigated.

Tornado Cash and the Anonymity Dilemma

The immediate transfer of the stolen ETH to Tornado Cash brings to the forefront the contentious role of cryptocurrency mixers. Tornado Cash is a decentralized privacy solution that allows users to obfuscate the origin and destination of their crypto transactions by mixing their funds with those of other users. While designed to provide legitimate financial privacy—a fundamental right in many contexts—it has also become a tool favored by hackers and illicit actors seeking to launder stolen funds.

The use of Tornado Cash in this hack, and many others, highlights a critical tension within the crypto space: the balance between privacy and regulatory compliance. On one hand, privacy is a core tenet of many blockchain advocates, offering protection against surveillance and censorship. On the other hand, its misuse by criminals fuels concerns from regulators worldwide, who view such tools as enabling money laundering and terrorist financing. This has led to sanctions against protocols like Tornado Cash by entities such as the U.S. Treasury Department, creating a complex legal and ethical landscape for developers, users, and businesses alike. For enterprises seeking to integrate blockchain solutions, understanding the implications of privacy tools and adhering to evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is becoming increasingly important for maintaining operational integrity and avoiding legal pitfalls.

Connecting the Dots: Implications for Financial Innovation and Digital Transformation

The Yearn Finance hack, alongside the broader landscape of DeFi exploits, carries profound implications for several key business imperatives:

Financial Innovation

DeFi represents a paradigm shift in financial services, offering decentralized lending, borrowing, trading, and asset management without traditional intermediaries. This fosters unprecedented financial innovation, enabling new business models and access to capital. However, each security breach erodes trust, a fundamental currency in finance. For institutional investors and corporations exploring DeFi, such incidents necessitate extremely rigorous due diligence, advanced risk assessment frameworks, and a clear understanding of smart contract insurance options. The long-term success of DeFi hinges on its ability to build resilient, secure, and trustworthy financial infrastructure that can withstand sophisticated attacks while continuing to innovate.

Digital Transformation

For businesses undergoing digital transformation, the lessons from the Yearn Finance hack are invaluable. Integrating blockchain technology into existing operations or building new Web3 ventures requires a comprehensive strategy that prioritizes security from the ground up. This extends beyond merely using blockchain for immutable record-keeping to actively engaging with smart contract development, secure key management, and robust incident response planning. Enterprises considering tokenization of assets, supply chain management on blockchain, or leveraging decentralized autonomous organizations (DAOs) must embed security audits, formal verification, and continuous threat monitoring into their digital transformation roadmaps. The cost of a breach, both financial and reputational, far outweighs the investment in proactive security measures.

Business Efficiency and Operational Optimization

Blockchain solutions promise significant strides in business efficiency and operational optimization by automating processes, reducing intermediaries, and enhancing transparency. For instance, smart contracts can automate escrow services, payment processing, and supply chain logistics, leading to substantial cost savings and faster operations. However, a vulnerability in a smart contract, as seen with yETH, can instantaneously negate these benefits, leading to operational disruption, asset loss, and severe efficiency setbacks. Businesses must carefully evaluate the maturity and security posture of any DeFi protocol or blockchain solution they plan to integrate. This involves assessing the track record of the development team, the robustness of their security audits, the existence of bug bounty programs, and the speed of their incident response. True operational optimization through blockchain requires a foundation of unassailable security.

Expert Takes: Navigating the Regulatory Currents

The increasing frequency and sophistication of DeFi exploits are inevitably accelerating regulatory scrutiny. Governments and financial watchdogs worldwide are grappling with how to regulate this nascent, borderless industry.

Expert Take: “The lack of robust Know Your Customer (KYC) and Anti-Money Laundering (AML) controls within many DeFi protocols, combined with the use of privacy mixers like Tornado Cash, is a growing red flag for regulators. Expect to see intensified efforts to bring DeFi under existing financial regulations, potentially impacting how decentralized protocols operate and how businesses can interact with them compliantly.” – Blockchain Policy Advisor

This perspective highlights the growing pressure on the DeFi ecosystem to evolve towards greater accountability. For businesses operating in regulated environments, compliance is not optional. Navigating these evolving regulatory currents requires proactive engagement with legal counsel, adoption of compliance-friendly decentralized solutions where possible, and a keen awareness of global policy developments that could impact their digital asset strategies.

Building Trust in a Trustless System: Moving Forward

The Yearn Finance yETH hack, while a significant blow, also offers critical lessons for the entire Web3 ecosystem. The decentralized nature of these protocols means that responsibility for security and recovery often falls to the community and the core development team. Moving forward, several key areas will be crucial for building trust in this “trustless” system:

- Enhanced Security Audits and Formal Verification: Investing in more frequent, in-depth security audits by multiple reputable firms is essential. Furthermore, formal verification—mathematically proving the correctness of smart contracts—will become increasingly vital for critical financial infrastructure.

- Robust Bug Bounty Programs: Incentivizing white-hat hackers to find and report vulnerabilities before malicious actors can exploit them is a proven strategy. Yearn Finance, like many protocols, likely has such a program, but continuous improvement and attractive rewards are necessary.

- Community Vigilance and Governance: Empowering the community through decentralized governance to review code, vote on proposals, and respond quickly to incidents can provide an additional layer of security and resilience.

- Decentralized Insurance: The growth of decentralized insurance protocols that offer coverage against smart contract exploits can help mitigate financial losses for users and institutions, thereby building confidence in DeFi participation.

- Developer Education and Best Practices: A continuous focus on educating developers about secure coding practices, common vulnerabilities, and new attack vectors is paramount.

The path to a truly robust and trustworthy decentralized financial system is fraught with challenges. However, the resilience and innovation of the Web3 community in the face of these setbacks are also evident. Each exploit, though damaging, provides invaluable data points for learning, improving, and hardening the underlying infrastructure.

FAQ Section

Q: What is Yearn Finance and yETH?

A: Yearn Finance is a leading decentralized finance (DeFi) protocol that functions as a yield aggregator, automatically optimizing users’ cryptocurrency earnings. yETH is a token within the Yearn ecosystem that represents a share in a diversified pool of Ether-based assets, designed to maximize yield for its holders.

Q: How did the Yearn Finance yETH hack occur?

A: The hack involved exploiting a critical vulnerability that allowed attackers to illegitimately mint a near-infinite number of yETH tokens. These fraudulently generated tokens were then used to drain legitimate Ether (ETH) from associated liquidity pools on Balancer, a decentralized exchange protocol.

Q: What is Tornado Cash, and why was it used?

A: Tornado Cash is a decentralized privacy solution that mixes cryptocurrency funds from various users, making it difficult to trace the origin and destination of transactions. Hackers frequently use it to obscure the trail of stolen funds, as was the case with the $3 million in ETH from the yETH exploit.

Q: What are the main security risks in DeFi?

A: Key risks include vulnerabilities in smart contract code, composability risks where a flaw in one protocol can affect others, economic exploits that manipulate token prices or liquidity, and the inherent lack of centralized recourse for stolen funds due to DeFi’s decentralized nature. While security audits are crucial, they are not always foolproof.

Q: What can businesses learn from this incident?

A: Businesses engaging with Web3 should prioritize comprehensive security strategies, rigorous due diligence, advanced risk assessment frameworks, and robust incident response planning. It underscores the need to understand evolving regulatory landscapes (like AML/KYC) and to integrate proactive security measures into all digital transformation efforts.

Conclusion

The Yearn Finance yETH exploit, resulting in the loss of $3 million to Tornado Cash, serves as a stark reminder of the volatile yet transformative nature of the DeFi landscape. For business professionals, entrepreneurs, and those navigating the complexities of digital assets, this event underscores several critical takeaways: the imperative of uncompromised security in smart contract development, the inherent risks of composability in a nascent ecosystem, and the evolving regulatory pressures on privacy-enhancing tools.

While the allure of Web3 for financial innovation, digital transformation, and operational optimization is undeniable, a prudent approach demands a deep understanding of the associated risks and a commitment to robust security frameworks. The future of decentralized finance hinges not just on groundbreaking innovation but equally on its ability to foster an environment of trust, transparency, and resilience. As the industry matures, the lessons learned from incidents like the yETH hack will undoubtedly pave the way for more secure, reliable, and ultimately, more impactful blockchain solutions for businesses worldwide. Vigilance, education, and proactive risk management remain the cornerstones for success in this dynamic digital frontier.