21Shares Taps Standard Chartered for Custody as TradFi Tightens Grip on Crypto

The financial landscape is witnessing a seismic shift, characterized by the accelerating convergence of traditional finance (TradFi) and the burgeoning world of digital assets. A recent development that underscores this profound transformation is the partnership between 21Shares, a leading provider of crypto exchange-traded products (ETPs), and Standard Chartered, a global banking giant, for digital asset custody. This strategic alliance, where Standard Chartered will provide digital asset custody services for 21Shares, is far more than a simple business agreement; it signals a deeper entrenchment of TradFi institutions into the core infrastructure of the cryptocurrency ecosystem, fundamentally reshaping its future trajectory and offering immense implications for business efficiency, digital transformation, financial innovation, and operational optimization across industries.

This move is a clear indicator that the “tightening grip” of traditional financial institutions on crypto is not a fleeting trend but a calculated strategic pivot. For business professionals, entrepreneurs, and crypto enthusiasts alike, understanding the nuances of this integration is paramount to navigating the evolving digital economy. It highlights a growing maturity in the digital asset space, where the stability, regulatory expertise, and vast infrastructure of established players are becoming indispensable.

Key Takeaways

- The partnership between 21Shares and Standard Chartered for digital asset custody signifies a critical convergence of traditional finance (TradFi) and the crypto ecosystem, moving digital assets toward mainstream adoption.

- Secure, institutional-grade digital asset custody is vital for attracting institutional investors, offering enhanced security, robust operational procedures, and stringent regulatory compliance.

- TradFi’s involvement brings significant benefits, including improved security and risk management, regulatory clarity, increased market liquidity and stability, and the development of sophisticated financial products.

- This integration acts as a powerful catalyst for broader digital transformation, financial innovation (like tokenization and programmable money), and operational optimization across diverse business sectors.

- The future landscape will balance the decentralized ethos of crypto with the trust and regulatory framework of traditional institutions, leading to greater investor protection and accessibility.

Table of Contents

- The Core of the Partnership: Custody and Confidence

- The Tightening Grip: Why TradFi’s Involvement Matters

- Connecting Crypto and Web3 to Business Transformation

- The Future Landscape: Challenges and Opportunities

- FAQ Section

- Conclusion

The Core of the Partnership: Custody and Confidence

At its heart, the partnership revolves around digital asset custody. In simple terms, crypto custody refers to the secure storage of digital assets, such as cryptocurrencies, on behalf of clients. Unlike traditional financial assets like stocks or bonds, which exist as entries in a ledger held by a central depository, cryptocurrencies are secured by cryptographic keys. Losing these keys means losing access to the assets. Therefore, secure custody is not just about safeguarding an asset; it’s about protecting the very means of accessing and transacting with that asset.

For institutional investors, the stakes are even higher. Managing significant volumes of digital assets requires enterprise-grade security, robust operational procedures, and stringent regulatory compliance. This is where a partnership with a global bank like Standard Chartered becomes a game-changer. 21Shares, a pioneer in offering regulated crypto investment vehicles such as Bitcoin and Ethereum ETPs, requires a custody solution that can meet the rigorous demands of institutional investors and regulatory bodies across various jurisdictions. By entrusting its digital assets to Standard Chartered, 21Shares is not just securing its holdings; it’s bolstering investor confidence, streamlining operational workflows, and further legitimizing digital assets within the traditional investment framework.

Standard Chartered, through its specialized digital asset custody arm or existing infrastructure, brings decades of experience in managing vast sums of traditional assets, navigating complex regulatory environments, and implementing state-of-the-art security protocols. This expertise is now being directly applied to the digital asset realm, offering a level of assurance that crypto-native solutions, while innovative, have historically struggled to provide at the institutional scale. This symbiotic relationship leverages 21Shares’ innovation in product development and market access with Standard Chartered’s unparalleled expertise in trust and security.

Expert Takes: The Institutional Imperative

The entry of major financial institutions into crypto custody is consistently cited by industry experts as a critical step toward mainstream adoption and market maturity.

“The involvement of global banking powerhouses like Standard Chartered in digital asset custody is the ultimate validator for institutional investors,” notes a leading blockchain consultant. “It signals that the infrastructure required for large-scale participation is solidifying, bridging the trust gap that has historically kept many traditional funds on the sidelines. This isn’t just about custody; it’s about legitimization and risk mitigation at a systemic level.”

A prominent digital asset fund manager commented, “For ETP providers like 21Shares, secure, regulated custody from a trusted TradFi entity isn’t just a ‘nice-to-have’—it’s a ‘must-have.’ It allows them to scale their offerings, attract a broader base of sophisticated investors, and operate with the same confidence and compliance standards as any traditional financial product. This is how crypto truly goes mainstream.”

The Tightening Grip: Why TradFi’s Involvement Matters

The phrase “TradFi tightening its grip on crypto” might evoke different reactions. For some, it represents a necessary maturation and professionalization of a nascent industry. For others, it might raise concerns about centralization, loss of the decentralized ethos, or increased regulatory scrutiny. However, from a business and investment perspective, this integration offers compelling advantages:

1. Enhanced Security and Risk Management

Traditional financial institutions have perfected risk management frameworks over centuries. Applying these to digital assets significantly reduces operational, cybersecurity, and financial risks associated with holding cryptocurrencies. Their robust security protocols, cold storage solutions, multi-signature authentications, and comprehensive insurance policies provide a bulwark against theft and loss, which have historically plagued the crypto space.

2. Regulatory Clarity and Compliance

One of the biggest hurdles for institutional adoption of crypto has been regulatory uncertainty. TradFi players operate under strict regulatory regimes and possess deep expertise in compliance. Their involvement brings a heightened focus on anti-money laundering (AML), know-your-customer (KYC), and other regulatory requirements, which are crucial for attracting institutional capital and fostering a legitimate market. This expertise helps navigate the fragmented global regulatory landscape, setting standards that can pave the way for clearer guidelines.

3. Increased Market Liquidity and Stability

As more institutional capital flows into digital assets through trusted intermediaries, market liquidity is expected to increase. Greater liquidity typically leads to more stable markets, reducing volatility and making digital assets more attractive to a broader spectrum of investors. This stability is critical for businesses looking to integrate blockchain and crypto into their operational models without being overly exposed to wild price swings.

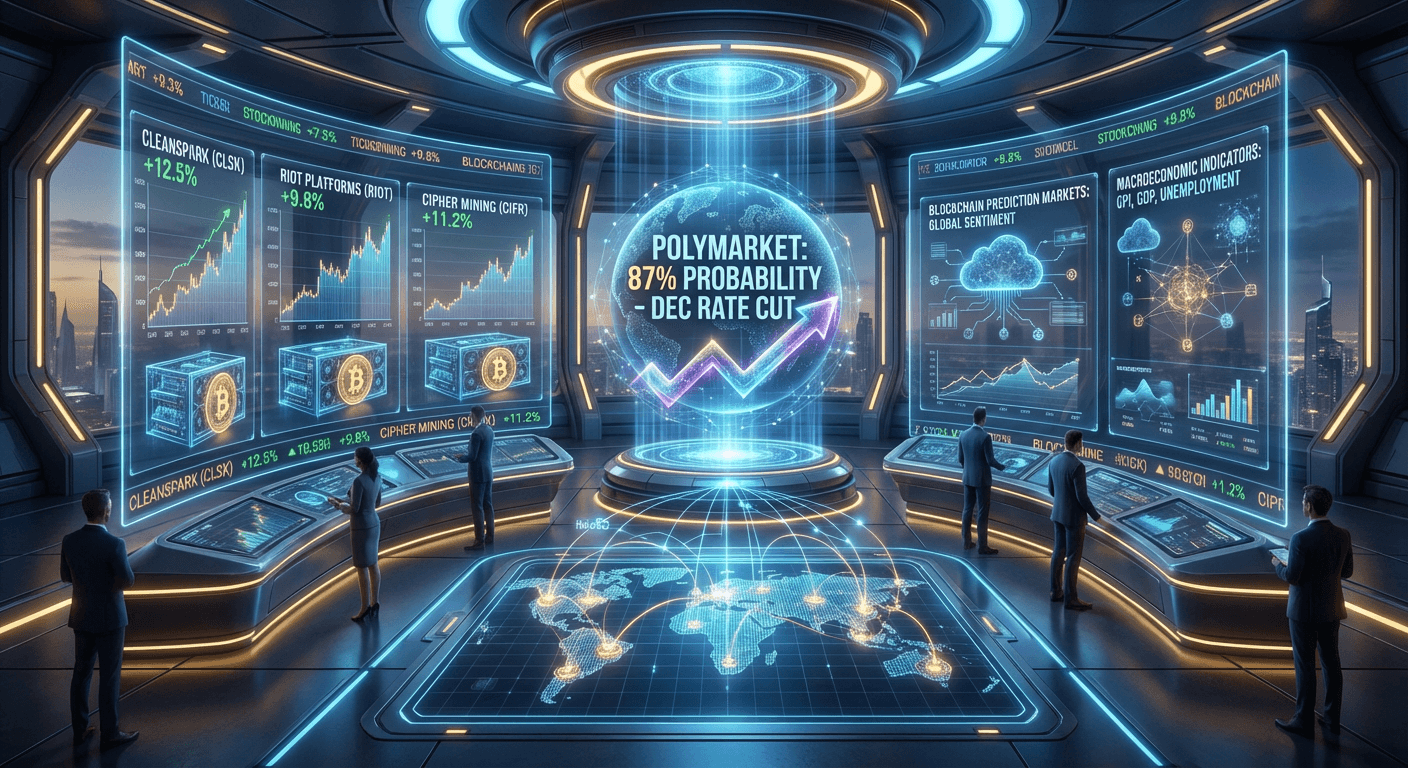

4. Development of Sophisticated Products

With robust custody in place, TradFi institutions can develop and offer a wider range of sophisticated financial products built on digital assets. This includes more diverse ETPs, structured products, lending and borrowing services, and even tokenized versions of traditional assets. This expansion accelerates financial innovation, creating new avenues for wealth creation and capital allocation.

5. Operational Efficiencies and Cost Reduction

While initially involving significant investment, integrating digital asset custody into existing TradFi infrastructure can ultimately lead to operational efficiencies. Automated processes, real-time settlement capabilities offered by blockchain, and reduced intermediaries can lower transaction costs and speed up operations in the long run.

The partnership between 21Shares and Standard Chartered also raises questions about the future role of crypto-native custodians like Zodia Custody, an institutional digital asset custodian backed by Standard Chartered and Northern Trust. While this specific news focuses on Standard Chartered’s direct role, it underscores a broader trend: established banks are either building their own crypto custody solutions or acquiring/partnering with existing ones. This suggests a competitive but ultimately maturing landscape where institutional trust and compliance are paramount, regardless of whether the solution is developed in-house or through a joint venture.

Connecting Crypto and Web3 to Business Transformation

The implications of this institutional embrace extend far beyond just investment products. The underlying technology – blockchain – and the broader Web3 movement are poised to drive profound transformations across various business sectors.

Digital Transformation: Beyond Financial Services

The integration of TradFi with crypto, exemplified by this custody partnership, is a powerful catalyst for broader digital transformation. Businesses across industries are recognizing that blockchain’s core attributes—immutability, transparency, and decentralization—offer solutions to long-standing challenges:

- Supply Chain Management: Enhanced traceability of goods from origin to consumer, reducing fraud and improving logistics efficiency.

- Data Management: Secure, verifiable data storage and sharing, critical for industries like healthcare, legal, and intellectual property.

- Identity Verification: Self-sovereign identity solutions that empower individuals and streamline verification processes for businesses.

As institutions become more comfortable with the secure handling of digital assets, they will naturally explore how the underlying blockchain technology can enhance their core operations, driving innovation that goes beyond the financial realm. This fosters an environment where enterprises are more willing to experiment with and adopt Web3 technologies, knowing that the foundational infrastructure for digital assets is robust and trustworthy.

Financial Innovation: A New Era of Assets and Services

The collaboration between 21Shares and Standard Chartered is a clear signal of ongoing financial innovation. It’s not just about traditional banks dipping their toes into crypto; it’s about a fundamental rethinking of how financial assets are created, managed, and transferred.

- Tokenization of Real-World Assets (RWAs): Secure custody from established players makes it easier to tokenize everything from real estate and art to company equity and intellectual property. This fractionalizes ownership, increases liquidity, and opens up new investment opportunities for a broader range of investors, making previously illiquid assets more accessible.

- Programmable Money: Stablecoins and central bank digital currencies (CBDCs), supported by institutional-grade custody, pave the way for “programmable money.” This allows for automated payments, conditional transfers, and smart contract-enabled financial instruments that can execute complex agreements without intermediaries, greatly enhancing efficiency in areas like trade finance and insurance claims.

- Decentralized Finance (DeFi) Integration: While seemingly paradoxical, TradFi custody can even facilitate institutional access to certain aspects of DeFi, albeit in a more controlled and compliant manner. Institutions can use secure custodians to manage their participation in regulated DeFi protocols, accessing new liquidity pools and yield-generating opportunities while adhering to internal compliance frameworks.

Operational Optimization and Business Efficiency

The operational benefits arising from institutional custody and the broader integration of blockchain are immense. For businesses, this translates directly into enhanced efficiency and reduced costs.

- Streamlined Settlement: Blockchain-based settlement systems can drastically reduce settlement times from days to near-instantaneous, particularly for cross-border transactions. This frees up capital, reduces counterparty risk, and improves cash flow management for businesses operating internationally. Secure custody is the bridge that allows institutional participants to leverage these benefits.

- Reduced Intermediaries and Costs: By leveraging blockchain, businesses can often bypass multiple intermediaries in processes like payments, asset transfers, and record-keeping. This reduces associated fees and speeds up operations, leading to significant cost savings.

- Enhanced Auditability and Transparency: The immutable ledger of blockchain provides an unparalleled level of auditability and transparency. For compliance, reporting, and internal controls, this means easier reconciliation, reduced human error, and a clearer trail for regulatory oversight, ultimately optimizing operational workflows and governance.

- Improved Asset Management: Institutional-grade custody provides sophisticated tools for managing digital asset portfolios, including advanced reporting, risk analytics, and seamless integration with existing financial systems. This optimizes asset allocation, rebalancing, and overall portfolio performance for institutional clients.

The Future Landscape: Challenges and Opportunities

While the “tightening grip” of TradFi offers numerous benefits, it also presents challenges. The crypto community, particularly those committed to decentralization, often views institutional control with skepticism, fearing that it might dilute the original ethos of peer-to-peer, permissionless systems. Balancing the need for institutional trust and regulatory compliance with the innovative, open nature of Web3 will be an ongoing challenge.

However, the opportunities far outweigh these concerns for businesses and investors. This institutionalization of digital assets means:

- Greater Investor Protection: Regulatory oversight brought by TradFi players will likely lead to enhanced investor protection mechanisms, reducing instances of fraud and market manipulation.

- Broader Accessibility: As digital assets become more securely and compliantly managed, they will become accessible to a much larger pool of investors, including pension funds, endowments, and corporate treasuries.

- Innovation within Bounds: TradFi’s involvement provides a framework for innovation that is both dynamic and responsible, encouraging the development of sustainable, legally compliant blockchain solutions.

FAQ Section

Q: What is the significance of the partnership between 21Shares and Standard Chartered?

A: This partnership signals a deeper entrenchment of traditional financial institutions into the core infrastructure of the cryptocurrency ecosystem. It fundamentally reshapes the future trajectory of digital assets, offering immense implications for business efficiency, digital transformation, financial innovation, and operational optimization.

Q: Why is secure digital asset custody important for institutional investors?

A: For institutional investors, secure custody is paramount because it involves safeguarding cryptographic keys that grant access to assets. It requires enterprise-grade security, robust operational procedures, and stringent regulatory compliance to manage significant volumes of digital assets and bolster investor confidence.

Q: How does TradFi involvement benefit the crypto market?

A: Traditional finance involvement brings enhanced security and risk management, regulatory clarity and compliance, increased market liquidity and stability, and accelerates the development of sophisticated financial products. This helps legitimize digital assets and reduces inherent market risks.

Q: What are the broader business implications of this integration beyond financial services?

A: Beyond finance, this integration acts as a catalyst for digital transformation across industries. It drives innovation in areas like supply chain management (traceability), data management (secure storage), and identity verification. It also fosters an environment where enterprises are more willing to adopt Web3 technologies, leveraging blockchain’s core attributes.

Conclusion

The partnership between 21Shares and Standard Chartered is a microcosm of a larger, irreversible trend. It underscores the maturation of the digital asset industry, its increasing integration into the global financial fabric, and its profound potential to reshape how businesses operate, innovate, and thrive in the digital age. For forward-thinking professionals, understanding these shifts is not merely about staying informed; it’s about positioning for success in an economy increasingly powered by blockchain and digital assets. The future of finance is a hybrid one, and the bridge between TradFi and crypto is being built brick by secure brick, with custody as a foundational element.