From Software to Satoshis: The Unlikely Rise of Corporate Bitcoin Hoarders

Public companies have quietly amassed a staggering 3% of all Bitcoin in existence—a move that’s reshaping markets, fueling stock rallies, and rewriting corporate finance playbooks. But how are they doing it? And why are investors pouring billions into companies that now treat Bitcoin like their primary business?

The answer lies in a high-stakes financial experiment, one where traditional corporations—from tech firms to hotel chains—are morphing into Bitcoin holding vehicles. And the strategy is working… for now.

The Bitcoin Treasury Boom: A $87 Billion Corporate Bet

In just one year, publicly traded companies have increased their Bitcoin holdings by over 150%, collectively sitting on $87 billion worth of BTC as of June 2025. That’s 3.2% of Bitcoin’s total supply—forever locked away on corporate balance sheets.

The trend was pioneered by Michael Saylor, the billionaire who transformed MicroStrategy (now rebranded as “Strategy”) from a software company into a Bitcoin acquisition machine. Today, Strategy’s market cap exceeds $100 billion—60% higher than the value of the Bitcoin it holds.

But Saylor is no longer alone. Companies from Japan to France are now racing to replicate his model, issuing shares and bonds to fund Bitcoin purchases. Some have even ditched their original businesses entirely, betting everything on crypto.

And the strategy is paying off—big time.

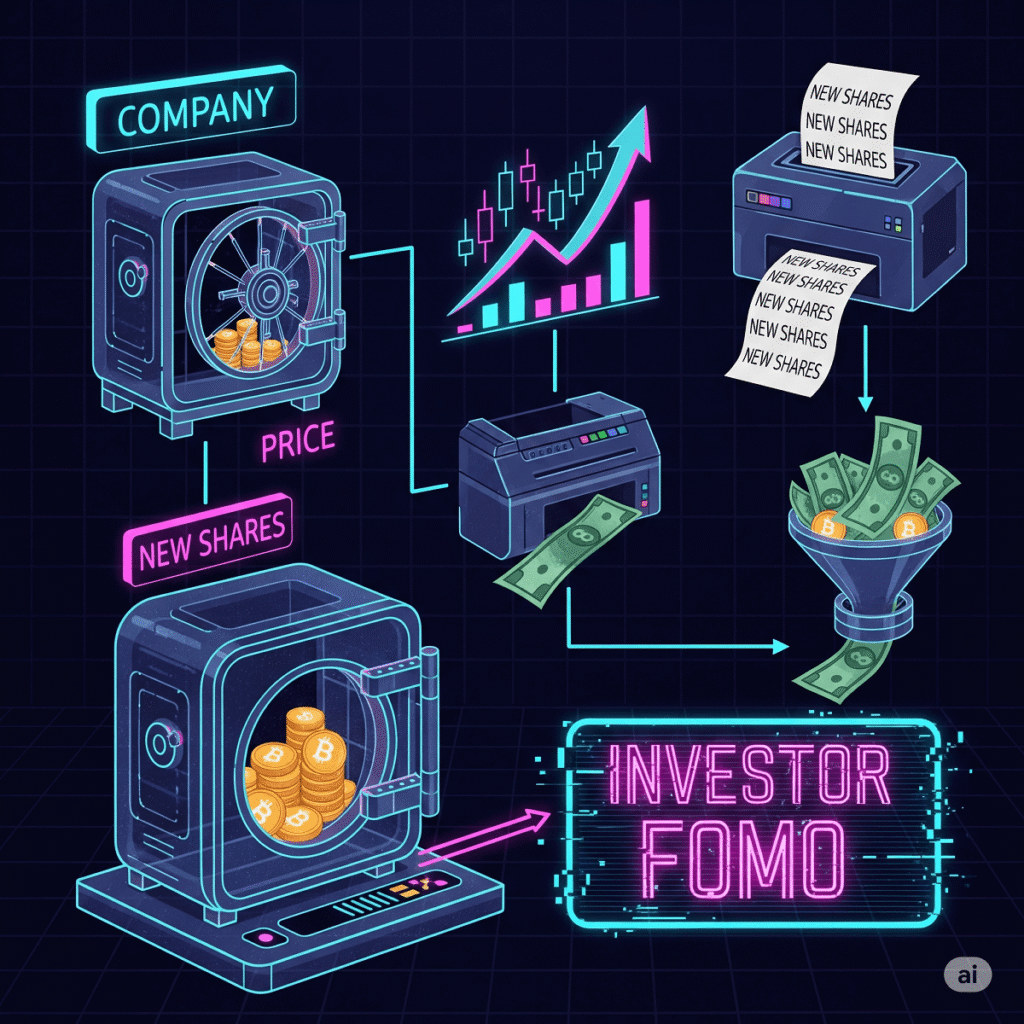

The “Infinite Money Glitch”: How Bitcoin Fuels Corporate Valuations

Here’s the secret sauce:

- A company announces it’s buying Bitcoin.

- Investors pile in, driving up the stock price.

- The company issues new shares or debt at inflated valuations.

- It uses that fresh capital to buy even more Bitcoin.

- The cycle repeats—stock surges, Bitcoin holdings grow, and early investors profit.

Market watchers call this the “infinite money glitch”—a self-reinforcing loop where rising Bitcoin prices justify higher stock valuations, which in turn fund more Bitcoin purchases.

But there’s a catch: What happens when Bitcoin crashes?

The Risk No One Wants to Talk About

So far, the Bitcoin treasury strategy has thrived in a bull market. But if prices plunge, companies loaded with debt and overvalued stock could face a reckoning.

Michael Saylor claims Strategy could survive a 90% Bitcoin crash—but admits shareholders wouldn’t be so lucky.

Still, the gamble hasn’t stopped a growing list of firms from jumping in.

The Biggest Players in the Corporate Bitcoin Game

Here’s who’s leading the charge—and how they’re pulling it off.

1. Strategy (MSTR) – The Original Bitcoin Whale

592,100 BTC (as of June 2025)

- The blueprint: In 2020, Saylor announced MicroStrategy would sell shares to buy Bitcoin—a move Wall Street initially mocked.

- The result: The company’s market cap outpaced Bitcoin itself, proving the model works.

- Latest move: Strategy plans to raise $42 billion over three years to keep buying BTC.

2. Twenty One Capital (CEP) – The New Challenger

37,230 BTC (and counting)

- Backed by Tether and SoftBank, this SPAC-turned-Bitcoin-holding-vehicle aims to dethrone Strategy.

- Already secured $3.9 billion in BTC—with more on the way.

3. Tesla (TSLA) – Elon’s On-Again, Off-Again Love Affair with Bitcoin

11,509 BTC

- Bought $1.5 billion in 2021, sold most of it, then jumped back in during 2024.

- Reported $600M in unrealized gains thanks to new accounting rules.

4. Metaplanet (3350) – From Hotels to Hard Money

10,000 BTC

- A Japanese ex-hotel company that went all-in on Bitcoin in 2024.

- Advised by Eric Trump, with plans to hold 210,000 BTC by 2027.

5. GameStop (GME) – The Meme Stock Meets Bitcoin

4,710 BTC

- Raised $2.25 billion in bonds to fund its sudden Bitcoin binge.

- Stock dipped post-announcement, but true to form, retail traders may yet rally behind it.

6. Trump Media (DJT) – The Coming Bitcoin Power Move?

0 BTC (for now)

- Plans to raise $2.5 billion to build a Bitcoin war chest.

- Could soon join the top corporate holders—just as the Trump administration pushes pro-crypto policies.

The Big Question: Is This Sustainable?

For now, the corporate Bitcoin rush is accelerating, driving prices higher and attracting more players. But if the music stops—if Bitcoin enters a prolonged bear market—some of these companies could find themselves overleveraged and underwater.

Until then? The game continues. And for investors, the real question is: Are you playing along—or just watching from the sidelines?