Is the crypto market a playground for thrill-seekers or a minefield for investors? The recent volatility of Bitcoin, the cryptocurrency king, has sent shockwaves through the market, leaving many to question the future of digital assets. In a dramatic turn of events, the crypto market has once again plummeted into a state of “extreme fear,” as indicated by the Fear and Greed Index. Let’s dive deep into the factors driving this sudden shift and explore what it means for investors.

Understanding the Fear and Greed Index

The Fear and Greed Index is a sentiment indicator that gauges the overall emotional state of the crypto market. It operates on a scale of 0 to 100, with 0 representing extreme fear and 100 indicating extreme greed. This index is calculated based on a variety of factors, including:

- Market Volatility: How much the prices of cryptocurrencies are fluctuating.

- Trading Volume: The amount of cryptocurrency being traded.

- Social Media Sentiment: The overall sentiment towards cryptocurrencies on social platforms.

- Search Trends: The popularity of cryptocurrency-related search terms.

A high index value suggests that investors are optimistic and willing to take risks, while a low value indicates fear and a potential sell-off.

Read More: Demystifying the Maze: A Beginner’s Guide to Crypto Trading

The Crypto Market’s Rollercoaster Ride

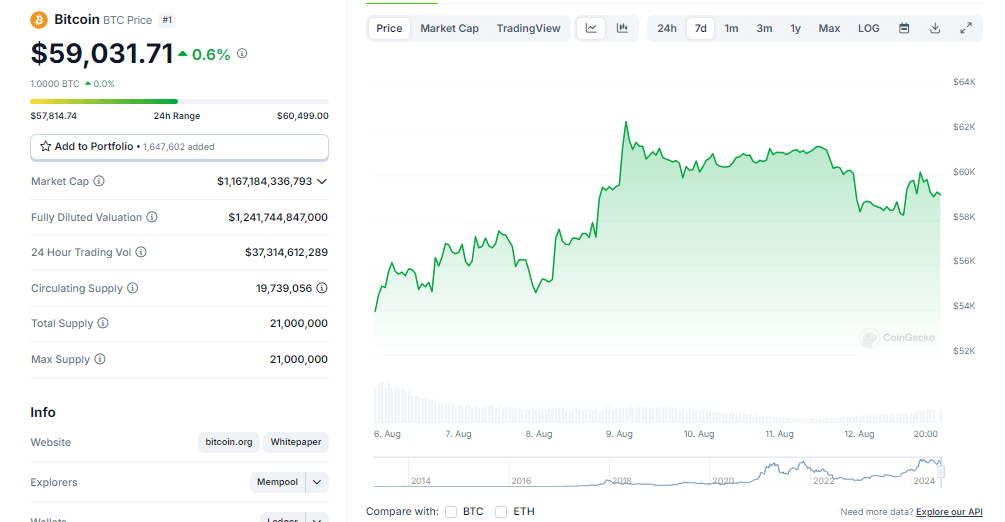

In recent weeks, the crypto market has experienced a rollercoaster of emotions. After a significant drop in Bitcoin’s price, the Fear and Greed Index plummeted to its lowest point of the year, indicating extreme fear among investors. However, a subsequent price recovery led to a brief respite, with the index climbing into the “fear” zone.

Unfortunately, this reprieve was short-lived. A renewed decline in Bitcoin’s value has pushed the market back into the depths of “extreme fear.” This rapid shift in sentiment highlights the highly volatile nature of the cryptocurrency market and the challenges faced by investors.

Implications of Extreme Fear

When the crypto market is gripped by fear, several consequences can unfold:

- Price Crashes: A surge in selling pressure can lead to rapid declines in cryptocurrency prices.

- Decreased Trading Volume: Investors may become hesitant to buy or sell, reducing market liquidity.

- Negative Sentiment: Fear can spread through the market, leading to a loss of confidence in cryptocurrencies.

It’s important to note that while fear can create opportunities for savvy investors to buy at lower prices, it can also lead to significant losses for those who panic sell.

What Does the Future Hold for Bitcoin and the Crypto Market?

Predicting the future of the crypto market is notoriously difficult. While the current state of extreme fear may seem daunting, it’s essential to maintain a long-term perspective. Historically, the crypto market has experienced periods of volatility followed by periods of growth.

Several factors could influence the market’s recovery:

- Regulatory Clarity: Clearer regulations can boost investor confidence.

- Institutional Adoption: Increased adoption by large financial institutions could drive market growth.

- Technological Advancements: Innovations in blockchain technology can create new opportunities.

Ultimately, the success of Bitcoin and other cryptocurrencies will depend on their ability to deliver real-world value and solve real-world problems.

Conclusion

The crypto market’s return to extreme fear is a stark reminder of the challenges and risks associated with investing in digital assets. While volatility is a defining characteristic of this market, it’s crucial for investors to approach it with caution and a well-thought-out strategy. By understanding the factors influencing market sentiment and maintaining a long-term perspective, investors can navigate the ups and downs of the crypto world with greater resilience.

Read More: Learn Crypto: Essential Resources for Cryptocurrency Enthusiasts