Money laundering, the process of disguising the origins of illegally obtained funds, has always been a challenge for law enforcement. With the rise of cryptocurrencies, criminals have found a new avenue to move and clean their dirty money. This article delves into the evolving landscape of money laundering through cryptocurrency, exploring the volume, methods, and the ongoing efforts to combat this illicit activity.

Where is the Most Money Laundered on the Crypto Market?

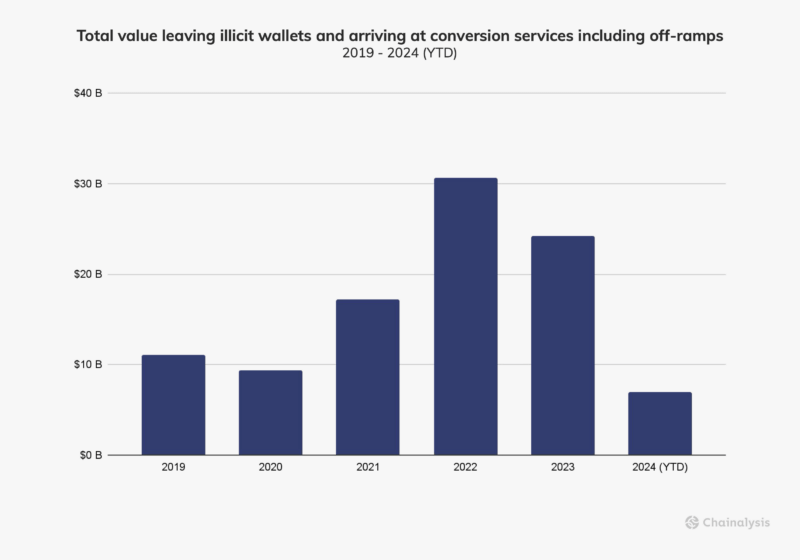

While the exact figures are difficult to pinpoint, estimates suggest a significant portion of cryptocurrency transactions involve money laundering. According to Chainalysis, a blockchain data analysis firm, over $100 billion in “dirty” cryptocurrency – linked to illegal activities – has been sent to exchanges in the past five years.

Interestingly, a sizeable chunk of this laundered money, roughly a third, can be attributed to sanctioned crypto services. These include platforms operating in regions with imposed financial restrictions, like the now-defunct Russian exchange Garantex. The situation highlights the critical role sanctions play in disrupting money laundering schemes that leverage cryptocurrency.

Here’s a table summarizing the factors that make certain areas of the crypto market attractive for money laundering:

| Factor | Description |

|---|---|

| Weak AML/KYC Regulations | Crypto exchanges operating in jurisdictions with lax Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations provide an easier entry point for criminals. |

| Privacy-Focused Coins | Certain cryptocurrencies prioritize anonymity, making it more challenging to trace the movement of funds and identify their origins. |

| Decentralized Exchanges (DEXs) | Unlike centralized exchanges, DEXs operate without a central authority, making it harder for law enforcement to track transactions. |

However, it’s important to note that not all cryptocurrency exchanges or privacy-focused coins are inherently involved in money laundering. Many reputable platforms implement robust AML/KYC measures to deter illicit activity.

The Rise of Stablecoins in Money Laundering

In 2019, Bitcoin dominated the crypto landscape used by criminals. Chainalysis co-founder Jonathan Levin reported that the first cryptocurrency comprised a staggering 95% of all “illegal” transactions. This landscape has shifted dramatically in recent years.

The emergence and subsequent growth of stablecoins – cryptocurrencies pegged to fiat currencies like the US Dollar – have presented new opportunities for money launderers. The market capitalization of Tether’s USDT, the largest stablecoin, has skyrocketed over 50-fold to $112 billion in the past five years. Similarly, Circle’s USDC has seen a staggering 100-fold increase, reaching a market cap of $34 billion. As of July 2024, the total market cap of all stablecoins surpasses a whopping $162 billion, according to Coingecko data.

This rise in stablecoin popularity can be attributed to several factors:

- Price Stability: Unlike traditional cryptocurrencies known for volatility, stablecoins offer a more predictable value, making them ideal for laundering funds.

- Faster Transactions: Compared to Bitcoin, transactions involving stablecoins are often processed quicker and at lower fees.

- Integration with Exchanges: Many centralized exchanges allow for easy conversion between stablecoins and fiat currencies, facilitating the final stage of money laundering – cashing out.

While stablecoins offer legitimate uses, their growing prominence necessitates stricter regulations and enhanced monitoring by authorities to prevent them from becoming a haven for illicit activity.

Our Money Laundering report reveals how bad actors now use crypto to launder funds from off-chain crimes — not just crypto-native crimes like ransomware. We explore advanced tracing techniques and how blockchain data is leading the fight against fincrime.https://t.co/32ApuphHpU

— Chainalysis (@chainalysis) July 11, 2024

Combating Money Laundering in Crypto: An Ongoing Battle

The fight against cryptocurrency money laundering is multifaceted. Here are some key strategies currently employed:

- Regulation: Governments worldwide are actively developing regulations for crypto exchanges and service providers, mandating stricter AML/KYC procedures.

- Law Enforcement Cooperation: International collaboration between law enforcement agencies is crucial for disrupting large-scale money laundering operations.

- Blockchain Analytics: Companies like Chainalysis provide blockchain analysis tools to help identify suspicious activity and track the movement of illicit funds.

- Technological Advancements: New technologies are being developed to trace transactions on privacy-focused blockchains, making it more difficult for criminals to hide their tracks.

The Future of Cryptocurrency and Money Laundering

Despite the ongoing efforts, money laundering through cryptocurrency remains a significant challenge. Here’s a glimpse into potential future developments in this space:

- Regulation Evolution: As the crypto market matures, regulations are likely to become more comprehensive and stringent. This could involve mandatory reporting of large transactions and stricter licensing requirements for crypto service providers.

- Technological Innovation: Advancements in blockchain analysis tools and transaction tracing capabilities on privacy-focused blockchains will make it harder for criminals to exploit loopholes.

- Decentralized Solutions: The rise of Decentralized Autonomous Organizations (DAOs) dedicated to AML compliance could offer innovative ways to identify and prevent illicit activity within the decentralized finance (DeFi) space.

The future of cryptocurrency and money laundering is intricately linked. While crypto offers legitimate financial opportunities, its potential for misuse necessitates a collaborative effort from governments, regulators, law enforcement agencies, and the cryptocurrency industry itself. By implementing robust regulations, fostering international cooperation, and leveraging technological advancements, we can create a safer and more transparent crypto ecosystem for everyone.

Frequently Asked Questions (FAQ)

Q: Are all cryptocurrencies used for money laundering?

A: No, not all cryptocurrencies are used for money laundering. Many legitimate businesses and individuals utilize cryptocurrencies for various purposes.

Q: Can I be sure the crypto exchange I use is safe from money laundering?

A: It’s crucial to choose reputable crypto exchanges with strong AML/KYC practices in place. Research the exchange’s background and ensure they comply with relevant regulations.

Conclusion

The fight against money laundering through cryptocurrency requires a multi-pronged approach. By understanding the evolving tactics of criminals, implementing effective regulations, and utilizing advanced technologies, we can make crypto a less attractive option for illicit activities. As the crypto market continues to grow, a commitment to combating money laundering is essential to ensure its long-term sustainability and legitimacy.