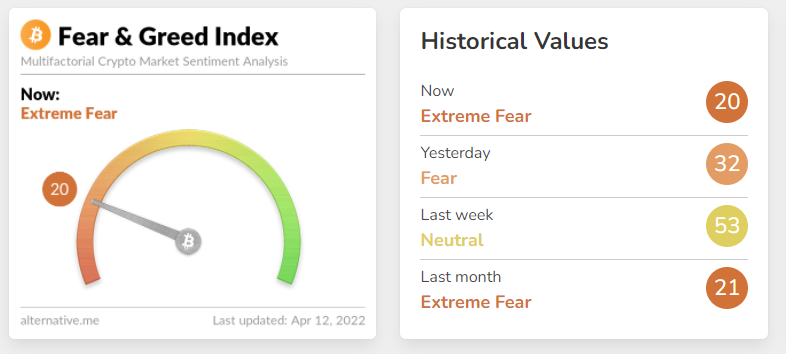

The Fear and Greed Index fell to 20. What does this mean and how does it affect the price of bitcoin

On April 12, the bitcoin rate fell to a local minimum of $39.2 thousand, the cryptocurrency costs $40.1 thousand, it fell by 3% in a day.

At the same time, the Crypto Fear & Greed Index fell to 20, while yesterday it was at 32, and last week – 53. The current value is considered extremely low, the last time it was observed at the end of February before bitcoin went up sharply.

What is the Fear and Greed Index?

Fear and greed are strong emotions that often influence the behavior of investors, including in the cryptocurrency market. The Fear and Greed Index is a sentiment indicator that shows which of these emotions prevails in the market.

The fear and greed index has a score ranging from 0 to 100. A low score indicates fear (the score is displayed in red), which leads to a sell-off of assets and a fall in the cryptocurrency market. A higher score means that greed is present (scores are displayed in green) and people are buying cryptocurrency.

“Extreme fear” ranges from 0 to 24, just “fear” is 25-49. A score of 50 points reflects a neutral state. A level of 51 to 74 indicates “greed”, while a score of 75 to 100 indicates “extreme greed”.

High fear in the market indicates the undervaluation of cryptocurrencies. Fear is accompanied by massive sales and panic in the market. However, fear does not necessarily mean that the market is in a long-term bearish trend. Fear can act as a short-term or medium-term slice of market sentiment.

Greed in the market is the opposite. If investors and traders are greedy, there is a possibility of overvaluation and a bubble. Cryptocurrency is actively bought up, which can lead to excess demand and an artificially high price.

When Bitcoin reached an all-time high of $69,000 in November 2021, the index reached 60 points. And this is far from a record value.

The market reached the mark of 95 points twice – on June 26, 2019 and on February 16, 2021. In the first case, the price of the cryptocurrency reached a local peak of $13.9 thousand after the collapse in 2018, in the second case it set a record of $50 thousand.

The index dropped to its lowest value of 5 points on August 22, 2019. Then the price of bitcoin fell to $10.1 thousand.

The index is calculated from February 1, 2018.

Index definition

Five parameters are currently used to calculate the Fear and Greed Index. Each of them is evaluated and compared with the previous day’s performance to visually demonstrate the change in market sentiment.

The following factors influence the value of the index:

- Volatility. This parameter compares the current price of bitcoin with 30 and 90 day averages. It is used as an indirect indicator of the level of fear in the market.

- The volume and dynamics of the market. Current volume and market momentum are measured (compared to the averages of the last 30 and 90 days), then the two values are correlated. As a rule, if high volumes of purchases are recorded daily against the backdrop of positive market conditions, this means that crypto investors are showing excessive greed (behaving too bullishly).

- Social media. Now this parameter is determined by analysis in Twitter. This social network collects and counts messages with various hashtags mentioning bitcoin. It then analyzes how quickly and actively users reacted to these messages. A high level of interaction leads to an increase in public interest in the coin.

- Bitcoin dominance. This parameter indicates a change in the share of bitcoin in the total capacity of the cryptocurrency market. The rise of bitcoin dominance is driven by fear of highly speculative investments in altcoins, so bitcoin is becoming an increasingly safe tool for storing capital. Conversely, when the dominance of BTC decreases, it means that people are becoming too greedy, investing in riskier assets.

- Trends. Google Trends data is analyzed for various Bitcoin related search queries. Particular attention is paid to changing the volume of search queries, as well as recommended and popular queries.