We tell you about the Fantom ecosystem, which is suitable for users with small deposits

The wallets of many users accumulate reserves of ERC20 tokens and the ether itself, which are often idle, due to the fact that it is unprofitable to issue loans or provide liquidity on DeFi platforms.

Ethereum network fees can be greater than potential profit. Interaction with smart contracts on the air makes sense only for large positions from $ 10 thousand and more.

If the user, for example, plans to interact with $ 1,000 in cryptocurrency, all commissions can be 10-20% of the amount, which negates the potential profit from providing loans or liquidity to pools. Also, working in the Ethereum network , users with medium-sized deposits lose their mobility – it will be expensive to change platforms in search of the best interest per annum.

The developers of many projects, understanding the user’s request and following the unspoken ideals of the crypto space to make financial services available to everyone, regardless of the size of the deposit, have created several solutions to the problem of high commissions.

In this article we will talk about Fantom (FTM ticker), an open source technology, the convenience of which is that you do not need to install additional software – the Metamask extension already available to most users is enough.

For developers of decentralized applications on the air, the project provides an opportunity to transfer their dApps to the Fantom Opera network in just a few clicks, significantly increasing bandwidth and reducing the cost of commissions.

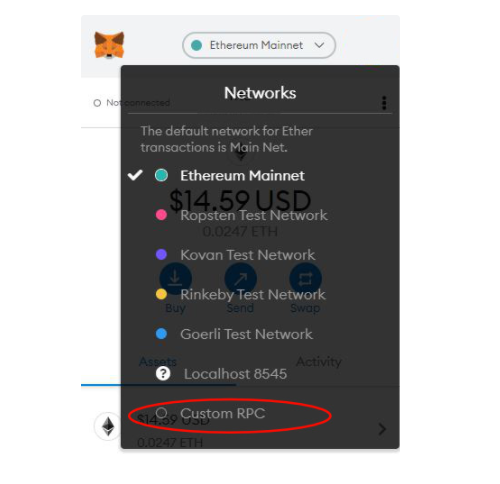

Configuring Metamask

Setting up the Metamask browser extension to work with the Fantom network will take a few minutes. After opening the extension, users click on the drop-down menu with the name of the currently connected network (for most, the Ethereum Mainnet is connected by default) and then select the “add network” option. In the window that opens, it will be necessary to fill in all the fields by copying the field values from the official Fantom instructions .

The Metamask extension can now switch between the two networks. You must be extremely careful when sending funds to any of the networks, since the user’s address on the Fantom network is exactly the same as on the Ethereum network, which can lead to confusion of addresses.

In most cases, tokens sent to the wrong network can be restored, but for this you have to export your private keys (endangering the safety of the entire wallet) and again pay commissions for interacting with the network.

If users are not accustomed to switching between the two networks in Metamask, it is recommended to start practicing with small amounts by making test transactions to each of the networks in order to get used to the mechanism of the extension.

The first useful small transaction is to send a small amount of FTM on the Fantom network from a centralized exchange to Metamask, which users can later use to pay network commissions.

We cross the bridge

By setting up the extension and mastering switching between the two networks, users can take advantage of the bridge and transfer ERC20 tokens from the Ethereum network to the Fantom network.

For our test, we used a bridge “at spookyswap.finance/bridge. At the moment, the bridge supports only the main ERC20 tokens, you can transfer to Fantom: DAI and other stablecoins, LINK token and ERC20 variant of ETH token – WETH token.

Crossing the “bridge” will take from 10 minutes to several hours and will cost as usual sending a token on the Ethereum network – from $ 5 to $ 20, depending on the network congestion.

There are limits on the minimum sending of tokens to another network: for example, it will be impossible to send less than 80 DAI or less than 2.73 LINK. As soon as the user’s tokens are in the Fantom network, you can start using smart contracts with minimal commissions of just a few cents.

It would be a good idea to use the bridge if the ERC20 tokens supported by the bridge are already in the same Metamask wallet, then only one action is required to cross the bridge.

If ERC20 tokens are on a centralized exchange, then it is more economical to get the desired token in the Fantom network according to the following scheme: exchange ERC20 tokens for FTM within the exchange, transfer FTM from the exchange to Metamask in the Fantom network, exchange FTM for the desired token using a swap already on the Fantom network.

Exploring a New Ecosystem

The transfer of tokens to the new network opens up a wide range of opportunities for interaction with projects running on Fantom. Most of the projects will delight users with good annual rates and a pleasant fabulous New Year’s aesthetics of interfaces. For our ecosystem test, we used the Spookyswap DeFi project to provide liquidity in USDC-TUSD stablecoin pair at 21% * per annum (conservative investment strategy in case of a bear market in 2022) and in LINK-FTM pair at 37% per annum (riskier investment strategy on the case of a bull market in 2022).

* Percentages per annum are indicated at the time of writing and will differ depending on the market situation, the size of the liquidity pools, the platform’s marketing strategy and other conditions.

The BOO tokens received as a reward for providing liquidity can be again staked on the same site to receive rewards in FTM at 38% per annum or stablecoin TUSD at 41% per annum (conservative strategy), or you can choose a small rare token with a price growth potential ( risky strategy).

Moderately frequent redirection of the received rewards to staking will make it possible to get a more profitable compound interest per annum in total due to capitalization of profits.

The small commissions of the Fantom network allow making the process of capitalizing the received rewards fully automated when using the BeefyFinance service and other similar projects.