Bitcoin, BTC, cryptocurrency, crypto market, Bitcoin price, Bitcoin analysis, Bitcoin prediction, Bitcoin weekly outlook, Bitcoin trading, Bitcoin news, Bitcoin rally, Bitcoin breakout, Bitcoin support, Bitcoin resistance, Bitcoin technical analysis, Bitcoin price forecast, Ethereum, ETH, ETH/BTC ratio, altcoins, crypto trading, crypto investing, Fed rate cuts, Federal Reserve, monetary policy, inflation, US economy, US-China trade deal, geopolitical risks, Middle East crisis, institutional crypto, Grayscale, Texas Bitcoin fund, crypto adoption, market sentiment, fear and greed index, trading volume, volatility, blockchain, digital assets, Web3, staking, crypto regulations, Bitcoin ETF, technical indicators, market trends, crypto investors, traders, short squeeze, liquidation, risk assets, safe haven, dollar weakness, market psychology, breakout levels, all-time high, resistance levels, support levels, crypto winter, bull market, bear market, sideways market, accumulation phase, crypto analysis, trading strategy, investment strategy, market outlook, economic data, non-farm payrolls, unemployment rate, ISM data, manufacturing PMI, services PMI, July 4th holiday, trading volume, liquidity, smart money, institutional investors, retail traders, market manipulation, price action, candlestick patterns, market structure, Bitcoin dominance, altcoin season, DeFi, NFTs, crypto regulations, digital gold, store of value, inflation hedge, macroeconomic trends, risk management, profit-taking, pullback, correction, upside potential, downside risks, market catalysts, news trading, event-driven trading, algorithmic trading, technical indicators, moving averages, RSI, MACD, Fibonacci levels, order flow, market depth, whale activity, exchange reserves, on-chain data, blockchain analytics, crypto fundamentals, network activity, transaction volume, hash rate, mining difficulty, institutional custody, crypto derivatives, futures, options, perpetual swaps, leverage trading, long positions, short positions, market makers, liquidity providers, arbitrage, spread trading, volatility trading, swing trading, position trading, day trading, scalping, crypto portfolio, asset allocation, risk-reward ratio, entry points, exit strategies, stop-loss, take-profit, trading psychology, FOMO, FUD, market cycles, accumulation, distribution, reaccumulation, parabolic moves, trend reversal, continuation patterns, breakout trading, range trading, support turns resistance, resistance turns support, Fibonacci retracement, Elliott Wave, Wyckoff method, volume profile, order book analysis, market microstructure, crypto exchanges, Binance, Coinbase, Kraken, Bybit, OKX, liquidity pools, stablecoins, USDT, USDC, fiat on-ramps, crypto regulations, SEC, CFTC, MiCA, tax implications, crypto wallets, cold storage, hardware wallets, security, hacks, exploits, smart contract risks, decentralized exchanges, CEX vs DEX, cross-chain bridges, Layer 2 solutions, Bitcoin Lightning Network, Ethereum scaling, gas fees, network congestion, mempool, transaction fees, proof-of-work, proof-of-stake, consensus mechanisms, validator nodes, staking rewards, yield farming, lending protocols, decentralized finance, Bitcoin halving, supply shock, scarcity, digital scarcity, Satoshi Nakamoto, whitepaper, max supply, circulating supply, market cap, trading pairs, BTC/USD, BTC/USDT, ETH/BTC, altcoin pairs, shitcoins, memecoins, pump and dump, rug pulls, due diligence, fundamental analysis, technical analysis, on-chain analysis, sentiment analysis, social media trends, influencer impact, Elon Musk, Michael Saylor, Cathie Wood, institutional adoption, corporate treasury, nation-state adoption, legal tender, El Salvador, Bitcoin bonds, mining stocks, public companies, MicroStrategy, Tesla, Block, Coinbase stock, crypto banking, Silvergate, Signature Bank, banking crisis, inflation hedge, hyperbitcoinization, fiat collapse, dollar devaluation, BRICS currency, CBDCs, digital yuan, FedNow, monetary debasement, sound money, hard money, store of value, peer-to-peer electronic cash, censorship resistance, financial sovereignty, unbanked, remittances, cross-border payments, smart contracts, programmable money, tokenization, RWAs, real-world assets, security tokens, utility tokens, governance tokens, DAOs, decentralized autonomous organizations, Web3 gaming, metaverse, virtual economies, play-to-earn, NFT gaming, digital collectibles, generative art, profile pictures, PFPs, Bitcoin ordinals, BRC-20 tokens, inscriptions, Bitcoin NFTs, Ethereum NFTs, OpenSea, Blur, Magic Eden, NFT marketplaces, NFT royalties, creator economy, fractionalized NFTs, NFT lending, NFTfi, DeFi protocols, Aave, Compound, MakerDAO, Curve Finance, Uniswap, SushiSwap, PancakeSwap, DEX aggregators, 1inch, Matcha, MetaMask, WalletConnect, Ledger, Trezor, self-custody, not your keys not your coins, multi-sig, Shamir backup, seed phrases, mnemonic phrases, air gaps, cold wallets, hot wallets, mobile wallets, desktop wallets, browser extensions, phishing scams, SIM swaps, social engineering, two-factor authentication, 2FA, hardware security keys, Yubikey, Google Authenticator, Authy, backup strategies, inheritance planning, crypto wills, dead man's switch, Bitcoin maximalism, Ethereum maximalism, altcoin season, market cycles, four-year cycle, stock-to-flow model, PlanB, rainbow chart, logarithmic growth curves, power law, Metcalfe's law, network effects, Lindy effect, antifragility, Black Swan events, tail risk, VaR, value at risk, correlation matrices, portfolio diversification, efficient frontier, Modern Portfolio Theory, CAPM, alpha generation, beta exposure, Sharpe ratio, Sortino ratio, risk-adjusted returns, absolute returns, relative returns, benchmark indices, crypto indices, CRIX, Bletchley indexes, market cap weighting, equal weighting, momentum investing, value investing, growth investing, contrarian investing, dollar-cost averaging, DCA, lump sum investing, value averaging, periodic investing, tax-loss harvesting, wash trading rules, FIFO, LIFO, HIFO, specific identification, cost basis tracking, crypto tax software, Koinly, CoinTracker, TokenTax, Accointing, ZenLedger, tax optimization, tax jurisdictions, capital gains tax, income tax, mining taxes, staking taxes, airdrop taxes, hard fork taxes, gift tax, estate tax, IRS Form 8949, Schedule D, FBAR, FATCA, international tax compliance, OECD crypto framework, travel rule, AML, KYC, CFT, financial surveillance, privacy coins, Monero, Zcash, Dash, privacy protocols, zero-knowledge proofs, zk-SNARKs, zk-STARKs, mixers, tumblers, CoinJoin, Wasabi Wallet, Samourai Wallet, JoinMarket, Whirlpool, blockchain analysis, Chainalysis, Elliptic, CipherTrace, forensics, deanonymization, Sybil resistance, pseudonymity, on-chain privacy, off-chain privacy, confidential transactions, Mimblewimble, Litecoin MWEB, Dandelion++, Tor, I2P, VPNs, proxy servers, IP obfuscation, node operation, full nodes, pruned nodes, archival nodes, light clients, SPV wallets, neutrino protocol, bloom filters, compact block relay, FIBRE, Erlay, transaction batching, coin selection algorithms, RBF, CPFP, fee estimation, replace-by-fee, child-pays-for-parent, mempool management, transaction acceleration, stuck transactions, double spends, chain reorganizations, selfish mining, eclipse attacks, Sybil attacks, 51% attacks, nothing-at-stake, long-range attacks, short-range attacks, time warp attacks, feather forking, sporking, soft forks, hard forks, user-activated forks, miner-activated forks, fork signaling, BIPs, EIPs, improvement proposals, backwards compatibility, version bits, flag days, activation mechanisms, MASF, UASF, BIP8, BIP9, BIP148, SegWit, Taproot, Schnorr signatures, MAST, Merkle trees, Patricia tries, state roots, receipt roots, bloom filters, transaction merklization, scriptless scripts, scriptPubKey, scriptSig, witness data, segregated witness, bech32 addresses, P2SH, P2WPKH, P2WSH, P2TR, address formats, vanity addresses, brain wallets, paper wallets, BIP39, BIP44, BIP32, HD wallets, derivation paths, multi-coin wallets, SLIP44, purpose fields, coin types, account indices, change addresses, gap limits, address reuse, coin control, UTXO management, dust attacks, forced address reuse, input linking, output linking, common input ownership heuristic, peel chains, coinjoin clusters, wallet fingerprinting, behavioral analysis, timing analysis, amount analysis, change detection, shadow wallets, shadow addresses, decoy outputs, cut-through, input subtraction, output subtraction, transaction graph analysis, cluster intersection, union, difference, subgraph isomorphism, taint analysis, flow analysis, betweenness centrality, clustering coefficient, graph density, component analysis, connectivity, reachability, neighbor analysis, degree distribution, power law fitting, preferential attachment, small-world networks, scale-free networks, random graphs, Erdős–Rényi model, Barabási–Albert model, Watts–Strogatz model, community detection, modularity maximization, label propagation, infomap, walktrap, edge betweenness, spin glass, stochastic block model, hierarchical clustering, k-core decomposition, clique percolation, motif detection, graphlets, graph kernels, spectral clustering, matrix factorization, non-negative matrix factorization, singular value decomposition, principal component analysis, independent component analysis, t-SNE, UMAP, autoencoders, node2vec, DeepWalk, GraphSAGE, GCN, GAT, graph neural networks, deep learning on graphs, graph embeddings, latent space, manifold learning, topological data analysis, persistent homology, Mapper algorithm, Vietoris-Rips complex, Čech complex, alpha shapes, witness complexes, discrete Morse theory, Reeb graphs, contour trees, merge trees, branch decomposition, treewidth, pathwidth, branchwidth, rankwidth, cliquewidth, boolean width, graph minors, forbidden minors, graph isomorphism, canonical labeling, nauty, bliss, traces, saucy, conauto, vf2, graph matching, subgraph isomorphism, maximum common subgraph, graph edit distance, graph kernels, random walk kernels, shortest-path kernels, graphlet kernels, Weisfeiler-Lehman kernels, propagation kernels, deep graph kernels, graph convolutional kernels, graph attention kernels, message passing neural networks, graph transformer networks, graph autoencoders, variational graph autoencoders, adversarial graph autoencoders, generative adversarial networks for graphs, graph normalizing flows, diffusion models for graphs, graph Boltzmann machines, graph Markov chains, graph hidden Markov models, graph conditional random fields, graph Markov random fields, graph Bayesian networks, graph belief propagation, graph junction trees, graph factor graphs, graph sum-product networks, graph arithmetic circuits, graph tensor networks, graph quantum circuits, graph neural Turing machines, graph differentiable neural computers, graph memory networks, graph relational networks, graph interaction networks, graph physics networks, graph molecular networks, graph chemical networks, graph biological networks, graph social networks, graph citation networks, graph co-authorship networks, graph web graphs, graph internet topology, graph road networks, graph power grids, graph brain networks, graph metabolic networks, graph protein-protein interaction networks, graph gene regulatory networks, graph food webs, graph ecological networks, graph linguistic networks, graph semantic networks, graph knowledge graphs, graph recommender systems, graph fraud detection, graph anomaly detection, graph cybersecurity, graph malware detection, graph intrusion detection, graph spam detection, graph fake news detection, graph misinformation detection, graph disinformation detection, graph propaganda detection, graph influence operations, graph social media manipulation, graph bot detection, graph sockpuppet detection, graph astroturfing detection, graph sybil detection, graph collusion detection, graph conspiracy detection, graph extremism detection, graph radicalization detection, graph hate speech detection, graph toxicity detection, graph abuse detection, graph harassment detection, graph cyberbullying detection, graph trolling detection, graph flaming detection, graph cyberstalking detection, graph doxxing detection, graph swatting detection, graph sextortion detection, graph child exploitation detection, graph human trafficking detection, graph terrorism detection, graph money laundering detection, graph sanctions evasion detection, graph proliferation financing detection, graph corruption detection, graph bribery detection, graph kleptocracy detection, graph tax evasion detection, graph market manipulation detection, graph insider trading detection, graph pump-and-dump detection, graph wash trading detection, graph spoofing detection, graph layering detection, graph smurfing detection, graph structuring detection, graph cuckoo smurfing detection, graph microstructuring detection, graph transaction laundering detection, graph trade-based money laundering detection, graph black market peso exchange detection, graph hawala detection, graph informal value transfer systems detection, graph underground banking detection, graph alternative remittance systems detection, graph mirror trading detection, graph round-tripping detection, graph tax avoidance detection, graph base erosion and profit shifting detection, graph transfer pricing manipulation detection, graph treaty shopping detection, graph shell companies detection, graph nominee arrangements detection, graph bearer shares detection, graph trusts detection, graph foundations detection, graph charities detection, graph NGOs detection, graph political organizations detection, graph lobbying detection, graph campaign finance detection, graph dark money detection, graph influence peddling detection, graph cronyism detection, graph nepotism detection, graph patronage detection, graph clientelism detection, graph pork barrel detection, graph earmarks detection, graph graft detection, graph embezzlement detection, graph misappropriation detection, graph diversion detection, graph skimming detection, graph kickbacks detection, graph bid rigging detection, graph price fixing detection, graph market allocation detection, graph customer allocation detection, graph territory allocation detection, graph product restriction detection, graph output restriction detection, graph quota fixing detection, graph collusive tendering detection, graph cover pricing detection, graph bid suppression detection, graph bid rotation detection, graph complementary bidding detection, graph phantom bidding detection, graph shill bidding detection, graph straw bidding detection, graph courtesy bidding detection, graph bid pooling detection, graph market division detection, graph group boycotts detection, graph exclusive dealing detection, graph tying detection, graph refusal to deal detection, graph predatory pricing detection, graph price discrimination detection, graph dumping detection, graph resale price maintenance detection, graph territorial restrictions detection, graph customer restrictions detection, graph exclusive territories detection, graph exclusive customers detection, graph profit pass-over agreements detection, graph profit-sharing agreements detection, graph profit-pooling agreements detection, graph profit-splitting agreements detection, graph profit-allocation agreements detection, graph profit-transfer agreements detection, graph profit-shifting agreements detection, graph transfer mispricing detection, graph false invoicing detection, graph overinvoicing detection, graph underinvoicing detection, graph multiple invoicing detection, graph phantom shipments detection, graph false descriptions detection, graph false classifications detection, graph false valuations detection, graph false weights detection, graph false quantities detection, graph false qualities detection, graph false origins detection, graph false destinations detection, graph false routing detection, graph false transshipment detection, graph false documentation detection, graph false certification detection, graph false labeling detection, graph false branding detection, graph false packaging detection, graph false marking detection, graph false stamping detection, graph false sealing detection, graph false tagging detection, graph false coding detection, graph false numbering detection, graph false dating detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering detection, graph false prioritizing detection, graph false scheduling detection, graph false timing detection, graph false sequencing detection, graph false ordering

Why retail investors are selling bitcoin at a loss?

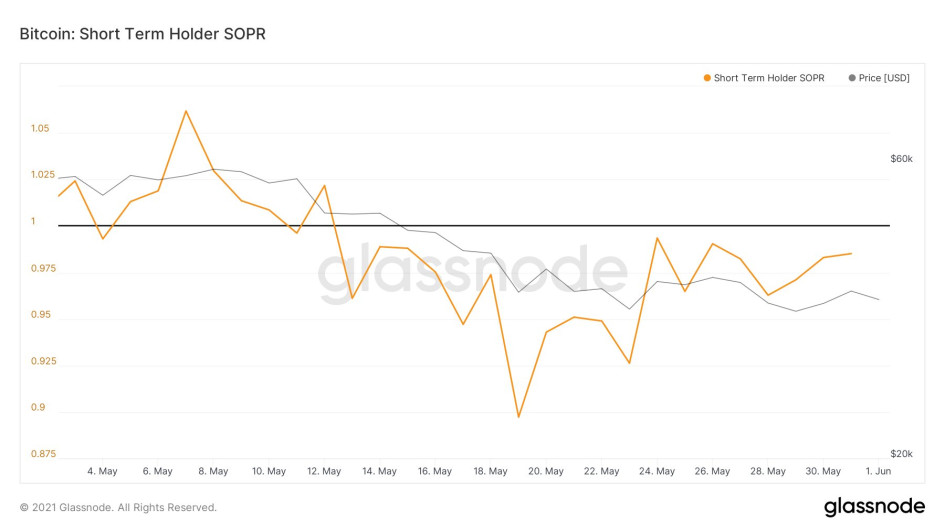

For the past two weeks, short-term holders have been losing money selling the main cryptocurrency . What was the reason for the exit from the asset , and how it could affect the crypto market ?

Short-term bitcoin coin at a loss over the past two weeks. This is indicated by the STH-SOPR indicator , which dropped below one, on the chart of the Glassnode analytical service.

The last two weeks – after the collapse of the crypto market on May 19 – the cost of bitcoin has been in the range of $ 33-40 thousand. During the collapse, the price of the main cryptocurrency dropped to $ 30 thousand for the first time since January 2021. Experts explained what forced investors to sell digital coins at a loss.

Short-term investors are investing in bitcoin in anticipation of rapid growth, but the trend of rapid growth has clearly ended, and therefore the sale began, says Artem Deev , head of the analytical department at AMarkets . According to him, now there are other instruments showing the best profitability, so investors sell bitcoin and transfer to them.

Sales may also occur against the backdrop of statements by the Chinese and US authorities about the need to tighten regulation of cryptocurrencies , the analyst explained.

“Most likely, the fall in bitcoin and other assets will continue – there is no incentive for growth in the foreseeable future, and the market is overheated. The increased attention of states to the digital coin market will mean an increase in the fall in assets, ”added Artem Deev.

Earlier, the Chinese authorities several times called for stricter regulation of mining and crypto trading , and the US Treasury proposed to introduce an obligation to transfer information on crypto transactions over $ 10 thousand to the Internal Revenue Service (IRS).

Casual and unprofessional investors panic and sell cryptocurrency , says Vladimir Smetanin , CEO of Newcent financial company. He noted that during such sales, other investors continue to accumulate digital coins , buying them cheaper.

According to Vladimir Smetanin , this indicates a phase of recruiting positions at low prices, which may push quotes up in the near future. Also, the expert does not exclude that a reverse reaction may occur, in which the cost of bitcoin will drop to $ 30 thousand.