For the past two weeks, short-term holders have been losing money selling the main cryptocurrency. What was the reason for the exit from the asset, and how it could affect the crypto market?

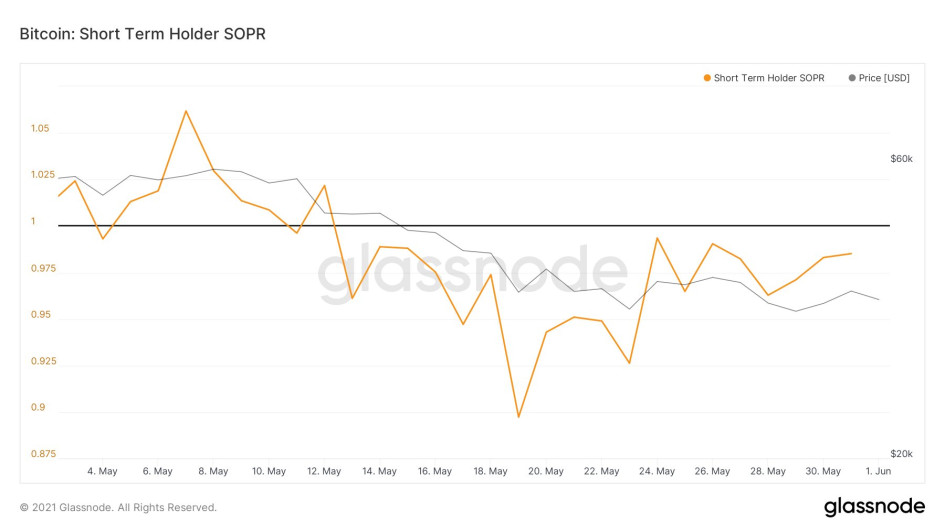

Short-term bitcoin holders have been selling the coin at a loss over the past two weeks. This is indicated by the STH-SOPR indicator, which dropped below one, on the chart of the Glassnode analytical service.

The last two weeks – after the collapse of the crypto market on May 19 – the cost of bitcoin has been in the range of $ 33-40 thousand. During the collapse, the price of the main cryptocurrency dropped to $ 30 thousand for the first time since January 2021. Experts explained what forced investors to sell digital coins at a loss.

Short-term investors are investing in bitcoin in anticipation of rapid growth, but the trend of rapid growth has clearly ended, and therefore the sale began, says Artem Deev, head of the analytical department at AMarkets. According to him, now there are other instruments showing the best profitability, so investors sell bitcoin and transfer to them.

Sales may also occur against the backdrop of statements by the Chinese and US authorities about the need to tighten regulation of cryptocurrencies, the analyst explained.

“Most likely, the fall in bitcoin and other assets will continue – there is no incentive for growth in the foreseeable future, and the market is overheated. The increased attention of states to the digital coin market will mean an increase in the fall in assets, ”added Artem Deev.

Earlier, the Chinese authorities several times called for stricter regulation of mining and crypto trading, and the US Treasury proposed to introduce an obligation to transfer information on crypto transactions over $ 10 thousand to the Internal Revenue Service (IRS).

Casual and unprofessional investors panic and sell cryptocurrency, says Vladimir Smetanin, CEO of Newcent financial company. He noted that during such sales, other investors continue to accumulate digital coins, buying them cheaper.

According to Vladimir Smetanin, this indicates a phase of recruiting positions at low prices, which may push quotes up in the near future. Also, the expert does not exclude that a reverse reaction may occur, in which the cost of bitcoin will drop to $ 30 thousand.